Bullish Bitcoin Technicals Thrills Analysts to Predict Next Leap Beyond $7,000

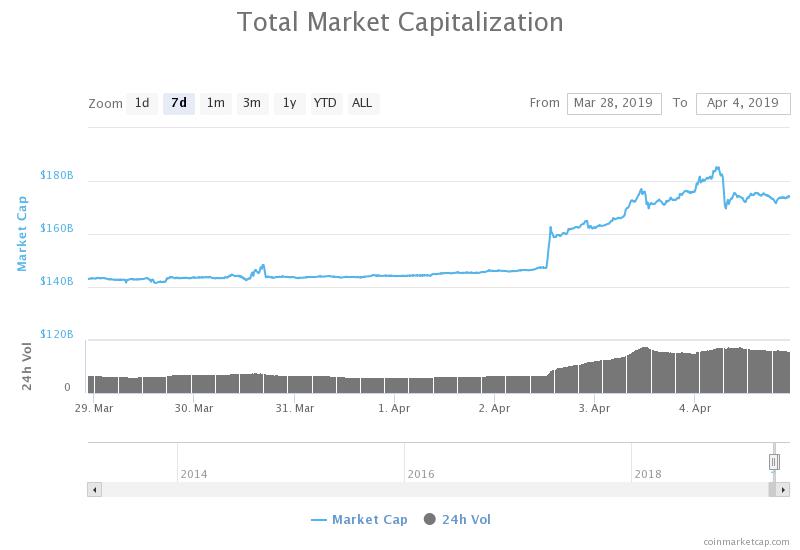

By CCN.com: As the bitcoin price slightly retraced below $5,000, the valuation of the crypto market dropped by $9 billion in the past 24 hours.

However, based on technical indicators, analysts remain convinced that the $5,000 to $6,000 range will be broken by bitcoin in the near-term and $7,000 is the next reasonable step for the dominant cryptocurrency.

The valuation of the crypto market dropped by $9 billion but in the past seven days, even with today’s drop, the market has added $28 billion.

WHY $7,000 FOR BITCOIN?

According to technical analyst Todd Butterfield, the bitcoin price is likely to gradually climb to the $7,000 resistance level in the months to come, possibly by the end of May.

The analyst presented positive indicators shown by Elliot Waves, which show that with several minor retracements and small rallies, the asset is en route to reach the $7,000 mark by the second quarter of 2019.

Similarly, Mati Greenspan, a senior market analyst at eToro, said that based on his analysis of the bitcoin price trend using the Fibonacci retracement tool, bitcoin could find itself at $7,000 before facing its first big sell wall.

A recovery to $7,000 would take bitcoin to July 2018 levels when the sentiment around cryptocurrencies was still fairly optimistic due to the strong performance of alternative cryptocurrencies.

As suggested by Fundstrat’s Thomas Lee, it is also important to note that unlike many traditional assets, bitcoin tends to record some of its biggest gains in a short time frame.

Historically, bitcoin has seen most of its largest returns in 10-day periods. With the asset breaking above the 200-day moving average for the first time in well over a year, a continuation of the momentum of the crypto market is expected.

If short contracts pile up in the near-term as bitcoin drops below $5,000 in a minor correction following a 19 percent increase in value, it could present a similar opportunity as April 2 when $500 million worth of short contracts on BitMEX were liquidated.

The liquidation of short contracts triggered a strong short squeeze, fueling the momentum of bitcoin and leading the price of the asset to surge.

WILL BITCOIN RECOVER FROM TODAY’S CORRECTION?

On Wednesday, CCN reported that for the first time in 15 months, a key technical indicator demonstrated a bullish trend for bitcoin.

Other technical indicators including the 200-day moving average and Ichimoku Clouds are all showing a positive near-term trend for the cryptocurrency market.

Bitcoin and the rest of the crypto market tend to move by cycles, which often lead the market to record large gains in short time frames.

As market analyst David Puell suggested, it is possible that with the bottom established at $3,122, the asset is in the process of beginning its third cycle in the past 9 years with a gradual accumulation phase.

“Still too little history to make definite conclusions, but Bitcoin velocity seems to be in the beginning phase of its third cycle as a mature asset with consistent internal economics. The fact that more economists aren’t interested in this stuff is flabbergasting to me,” noted Puell.

Responses