BUSD Depegs From Rival Stablecoin Tether After New York Regulator Tells Paxos to Stop Minting New Tokens

Traders seem to be migrating from Paxos’ BUSD stablecoin to tether.

Binance’s dollar-pegged stablecoin BUSD turned volatile in the wake of regulatory action against its issuer Paxos Trust Co.

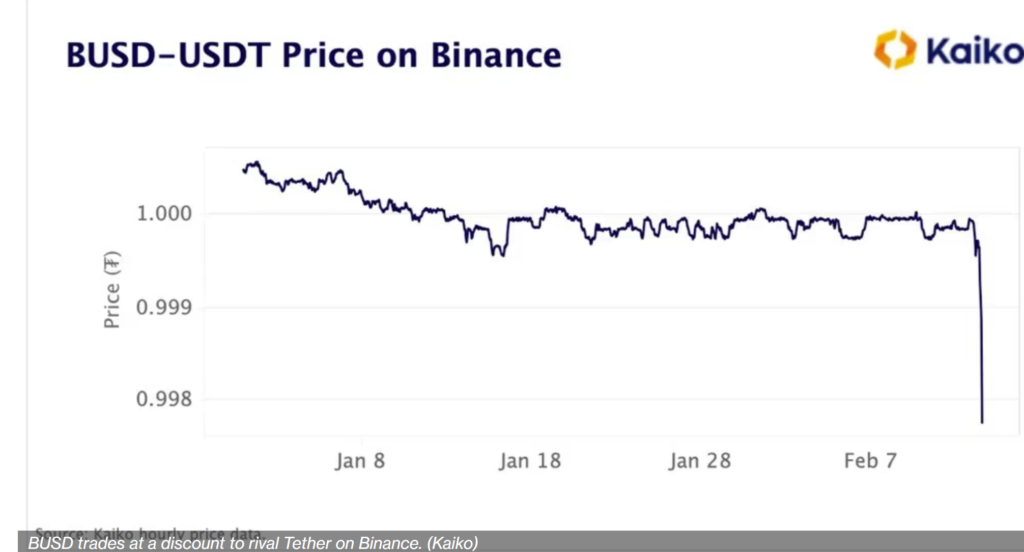

Early Monday, BUSD, designed to maintain a 1:1 value with the U.S. dollar, slipped into a discount of 0.9950 against its rival tether (USDT) on Binance, according to data provided by Kaiko. Tether is the world’s largest dollar-pegged stablecoin by market value.

The de-pegging to the lowest level in over a year happened after the New York Department of Financial Services ordered Paxos Trust Co, which issues and lists BUSD, to stop minting more of its tokens.

Paxos announced that it would cease the issuance of new BUSD tokens from Feb. 21 and end its relationship with Binance while assuring BUSD holders that every coin is backed by 1:1 with US dollar-denominated reserve. Further, the company will continue to manage redemptions of the product, according to a Binance statement.”

The decline in BUSD/USDT pair on Binance suggests some traders are moving money into tether.

“Essentially, by halting issuance of BUSD, there is no way for the stablecoin to grow. BUSD trading pairs will still be supported by Binance, but traders will gradually start to migrate to other stablecoins, which could be causing the discount on BUSD,” Kaiko’s research director Clara Medalie told CoinDesk.

Some in the investor community believe BUSD’s discount could be short-lived, given Paxos won’t mint new coins but will continue to honour redemptions. BUSD accounts for 35% of total volume on trading volume Binance.

By: OmKar Godbole

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.