SBF Trial: Defense Counsel’s Cross-Examination of Star Prosecution Witness Meandered

Mark Cohen bumbled at times, asking Caroline Ellison to repeat much of the same information she told prosecutors in testimony the day before.

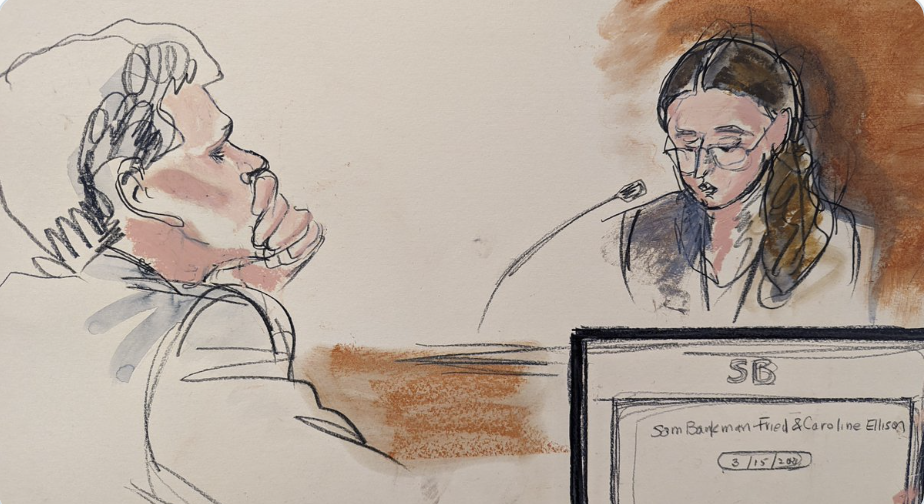

NEW YORK — Early on, Sam Bankman-Fried’s defense attorney hinted that his questioning of star prosecution witness Caroline Ellison would deflect blame from his client toward her, but he never seemed to quite hit that actual note before finishing his cross-examination Thursday afternoon.

Attorney Mark Cohen walked Ellison through a number of topics pertaining to last year’s collapse of FTX and her role in running sister company Alameda. She seemed to become quite comfortable on the stand, correcting Cohen and answering far more than what he actually asked on multiple occasions. The defense attorney wrapped up with her without actually trying to assign her blame for her culpability in the FTX catastrophe.

In the first hour of testimony Thursday morning, he had asked several questions about the extent to which Ellison helmed Alameda independently of Bankman-Fried.

Cohen asked Ellison if it was true that his client was absent for “long periods of time” while she was CEO at Alameda. She said it was.

He also asked if, during those times, Ellison and Sam Trabucco, who at one point was her co-CEO, made decisions without Bankman-Fried’s input. She acknowledged they did.

Ellison, 28, wrapped up her testimony Thursday, her third day of questioning. Sporting the same gray blazer as the last two days, Bankman-Fried’s ex-girlfriend was asked about her company’s accounting.

Read more: Who Is Alameda Research’s Caroline Ellison?

Alameda engaged with a few accountants in 2021 to 2022, but after those firms reviewed Alameda’s books, “they found they couldn’t or wouldn’t do it,” Ellison said, as she faced questions from Cohen. Former FTX Digital Markets CEO Ryan Salame initially prepared Alameda’s balance sheets, but at some point, Ellison took over this task, she testified.

The company’s financials are at the center of Bankman-Fried’s demise. An award-winning CoinDesk story in November 2022 that cited Alameda’s confidential balance sheet caused many to doubt the viability of Alameda and FTX.

Cohen also asked about Ellison’s early days at Alameda and disputes among multiple employees at the company that happened before she joined in 2018. Neither Cohen nor Ellison said more about the disputes besides her acknowledging she had heard about them. It was unclear what Cohen was referring to.

The defense counsel also asked Ellison if she was an ambitious person. While she said she didn’t consider herself to be an ambitious person early in her career, she recalled being more driven during her time at Alameda.

“I became more ambitious as Sam encouraged me in that,” she said.

Awkward moments

Cohen bumbled at times, asking Ellison to repeat much of the same information she told federal prosecutors during her testimony the day before.

He asked a number of questions about disparate topics, including the terms of Ellison’s agreement with prosecutors, some of the documents she put together and the decision-making process at Alameda. There was no immediate common thread beyond Ellison herself and her role at Alameda.

At one point, Cohen rattled off the names of nearly every single month of the year as he asked a confused-looking Ellison if she had met with prosecutors during each of those months. The meandering line of questioning invited several objections from the prosecution and a couple of warnings from the judge.

Minutes into the cross-examination, Cohen called for a sidebar – a request he has made frequently throughout the trial. The ask appeared to exasperate Judge Lewis Kaplan, although he ultimately granted it.

“We’re not gonna do this all day,” Kaplan warned Cohen.

Despite that warning, Cohen continued to call for sidebars and ask Ellison a series of repetitive questions, prompting Kaplan, and the prosecution, to snap at the defense.

“We’ve had several minutes of the same line of questioning,” Assistant U.S. Attorney Danielle Sassoon said after raising one particular objection.

In response, Cohen offered an explanation for his method of questioning, but Kaplan quickly shot down the rebuttal.

“I’d like you to go onto something else,” Kaplan told Cohen.

Ellison appeared equally vexed with Cohen’s legal strategy, making her frustration known during one particularly confusing part of the cross-examination in which he asked the former Alameda executive a question about the trading firm’s borrowing practices.

“Do you have anything more specific?” Ellison asked Cohen.

Terms of service

A letter sent by Cohen to the judge in parallel with Thursday’s hearing suggests the line of questioning he might want to take with witnesses once Ellison is out of the way.

FTX customers’ rights are “not established by their expectations and understandings,” Cohen argued in a Thursday filing, suggesting that what an earlier witness for the prosecution, commodities trader Marc-Antoine Julliard, hoped for from the exchange was less important than the actual contractual terms of service, drafted under English law.

Cohen, who has previously been told by the judge he can’t probe whether FTX clients were simply negligent or gullible, has now said he wants to ask Julliard and Paradigm co-founder Matt Huang about the “factors they considered material” when signing up for the crypto exchange.

Defense strategy

Previously, Cohen has argued Ellison is the one responsible for the FTX exchange’s dramatic collapse last year.

“Bankman-Fried relied on Ellison and he trusted her to act as the CEO and manage the day-to-day,” Cohen said in his opening statement last week. “As the majority owner of Alameda, he spoke to Ms. Ellison, the CEO, and he urged her to put on a hedge, something that would protect against such a downturn. She didn’t do so at the time, and this also becomes an issue later on, when the storm hit.”

Sassoon pushed back against that narrative in her direct questions to Ellison, walking the former trader through her conversations with Bankman-Fried about Alameda’s financial position over the years before FTX’s collapse. The two spent quite a bit of time discussing an analysis Ellison put together of Alameda’s financials in response to Bankman-Fried saying he wanted to invest in more venture projects. Ellison said she recommended against doing so, but Bankman-Fried announced new venture investments in January 2022 anyway.

Months later, Bankman-Fried blamed her for not hedging Alameda’s risks, Ellison said.

While Ellison “absolutely could and should” have hedged Alameda’s risks earlier in the year, the problem was that Bankman-Fried had decided to make a number of investments that put Alameda into an unsound financial situation, she said.

“I thought that hedging could have helped our situation, but I felt that the fundamental reason we were in the situation was that we had borrowed these billions of dollars in open-term loans and used them for illiquid investments,” she said, and Bankman-Fried had made the decision to make those investments.

Another prosecution witness

Alameda software engineer Christian Drappi took the stand after Ellison’s testimony came to a close.

The centerpoint of his testimony was a fateful Alameda all-hands meeting hosted by Ellison just days after FTX’s liquidity crisis came to light in November 2022.

Drappi revealed that the meeting, which has been reported on previously, was secretly recorded by an Alameda employee who’d joined the firm just three days before it imploded.

Alameda “borrowed a bunch of funds on FTX, which led to FTX having a shortfall in user funds,” Ellison could be heard saying in an excerpt from the recording shared with the jury.

In the recording, Drappi asked Ellison if there was a plan to eventually pay back FTX creditors. She responded that “FTX was trying to raise money in order to do this,” but added the fundraising efforts ultimately fell apart. The revelation that FTX attempted to raise money to pay back its lenders caused Drappi to grow even more concerned.

Companies typically raise funds when they have something “exciting” going on, Drappi said he recalled thinking when he initially heard Ellison’s remark, “not to fill a hole in a balance sheet.”

Prosecutors shared the audio tapes in an attempt to bolster Ellison’s credibility with the jury. In theory, the all-hands meeting shows the Alameda CEO admitting to crimes before she had a personal interest in doing so. The tapes were recorded before Ellison was aware of FTX criminal investigations and prior to her making a plea deal with prosecutors.

Ellison said in the recording that she, Bankman-Fried and FTX executives Gary Wang and Nishad Singh were aware that Alameda used FTX customers’ money.

“FTX basically always allowed Alameda to borrow user funds as far as I know,” she said at the meeting in response to a question from an employee.

The Alameda CEO appeared “sunken” as she spoke, said Drappi, who ascribed a spurt of laughter from Ellison as “nervousness.”

In a recording played later during Drappi’s cross-examination, though, Ellison’s laugh was louder. When Judge Kaplan admitted the audio as evidence, Bankman-Fried’s lawyer, Christian Everdell, negotiated with the judge to append an additional portion that prosecutors had initially excluded.

In the defense’s piece of the recording, an Alameda employee could be heard thanking Ellison for her openness and honesty about the situation, acknowledging that “I’m sure it wasn’t fun.”

Ellison let out a louder laugh this time. “I mean, it was kind of fun,” she responded, still chuckling. The defense had no more questions after the recording.

Jack Schickler contributed reporting.

BY: Nikhilesh De, Elizabeth Napolitano, Sam Kessler, Helene Braun

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.