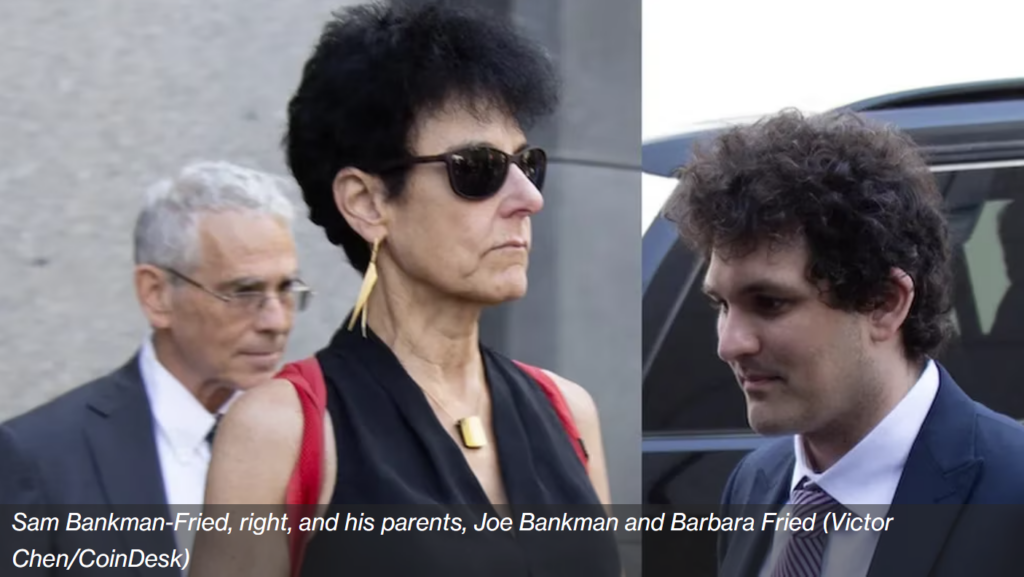

Sam Bankman-Fried Sentenced to 25 Years in Prison

The former FTX CEO was convicted of seven counts of fraud and conspiracy in November, a year after the once-giant cryptocurrency exchange collapsed.

Sam Bankman-Fried must spend 25 years in prison for the fraud and conspiracy scheme that ultimately undid his once-giant cryptocurrency exchange FTX, a federal judge ruled on Thursday.

Bankman-Fried was also fined $11 billion.

As he prepared to deliver the sentence, Judge Lewis Kaplan said Bankman-Fried never offered “a word of remorse for commission of terrible crimes.” Kaplan said Bankman-Fried’s attempt to craft a positive and altruistic persona in the public eye was, at least in part, “an act.” He said, “Mr. Bankman-Fried’s name is pretty much mud right now around the world,” but he is “persistent” and “a great marketing guy.” The judge rejected the defense’s argument that Bankman-Fried was not at risk of committing future crimes.

The judge announced his decision after a two-hour hearing in a Manhattan courtroom during which prosecutors, Bankman-Fried’s attorney, a victim, a lawyer who spoke on behalf of other FTX victims and Bankman-Fried himself delivered comments to Kaplan. This followed Bankman-Fried’s conviction on seven criminal counts in November, a year after FTX filed for Chapter 11 bankruptcy. The former FTX CEO will appeal his conviction, according to his lawyer Thursday, a process that couldn’t begin until Kaplan’s sentencing decision.

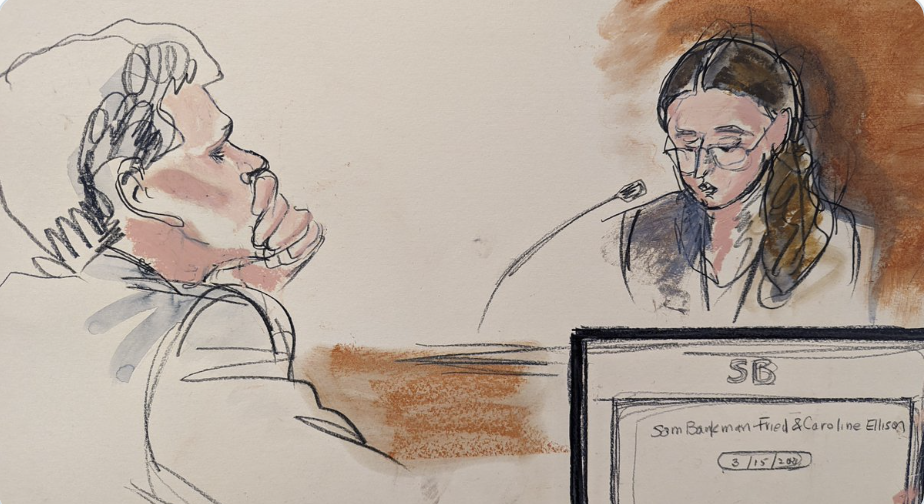

Prior to receiving his sentence from the judge, Bankman-Fried spoke for several minutes in which, repeatedly, he made the claim that “there were enough assets, there are enough assets” for FTX’s creditors to get paid back in full. Bankman-Fried and the victim and victims’ attorney who also spoke focused primarily on the FTX bankruptcy estate and its proposed payouts to creditors, which they all said are lower than they should be given current market prices. Bankman-Fried named three of the government’s key witnesses, Nishad Singh, Gary Wang and Caroline Ellison, and expressed regret for his role in FTX’s collapse.

“At the end of the day, I was responsible,” said Bankman-Fried. “My useful life is over. It’s been over for a while now.”

Bankman-Fried faced up to a century in prison, based on a report from a probation officer. Kaplan wasn’t bound to this recommendation. Bankman-Fried’s defense team – a different group of lawyers than the ones who represented him during the five-week trial – asked for no more than 6 1/2 years, while U.S. Department of Justice prosecutors sought 40 to 50 years behind bars.

The DOJ said Bankman-Fried deserved a severe penalty, citing the fact that FTX, which was once valued at $32 billion, lost essentially all its money due to his malfeasance. During the trial, prosecutors said Bankman-Fried stole $8 billion of customer money to fund venture-capital investments, real-estate purchases, political donations and more. Prosecutors submitted dozens of victim impact statements from former FTX customers as evidence, saying the sheer scale of the fraud Bankman-Fried was convicted on supported a harsher penalty – though one that was half what he technically could face.

Defense lawyers argued, on the other hand, that Bankman-Fried didn’t intend to defraud customers, had shown remorse and had attempted to resolve FTX’s bankruptcy after it began, saying the DOJ’s proposal was extreme. Their supporting letters spoke more to Bankman-Fried as a person than to FTX and its collapse, with writers pointing to his veganism and anecdotes from his youth. Several letters said Bankman-Fried appeared to be neurodivergent and thus might not have understood the severity of the situation. Former New York Police Department officer Carmine Simpson, his fellow inmate in a Brooklyn detention facility who pleaded guilty to soliciting a minor, wrote a letter saying Bankman-Fried, a vegan, has been forced to eat poorly in jail.

“Today’s sentence will prevent the defendant from ever again committing fraud and is an important message to others who might be tempted to engage in financial crimes that justice will be swift, and the consequences will be severe,” Damian Williams, U.S. Attorney for the Southern District of New York, said in a statement on social media platform X. “The scale of his crimes is measured not just by the amount of money that was stolen, but by the extraordinary harm caused to victims, who in some cases had their life savings wiped out overnight.”

BY: Nikhilesh De

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

CoinDesk is an award-winning media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of editorial policies. In November 2023, CoinDesk was acquired by the Bullish group, owner of Bullish, a regulated, digital assets exchange. The Bullish group is majority-owned by Block.one; both companies have interests in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin. CoinDesk operates as an independent subsidiary with an editorial committee to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.