Liquid Staking Replaces DeFi Lending as Second-Largest Crypto Sector

The value of cryptocurrencies deposited in liquid staking protocols has increased to about $14 billion, trailing just deposits at decentralized exchanges.

Liquid staking, which allows users to earn rewards for locking cryptocurrency in a blockchain network while retaining the liquidity of the locked funds, is now bigger than decentralized lending and borrowing.

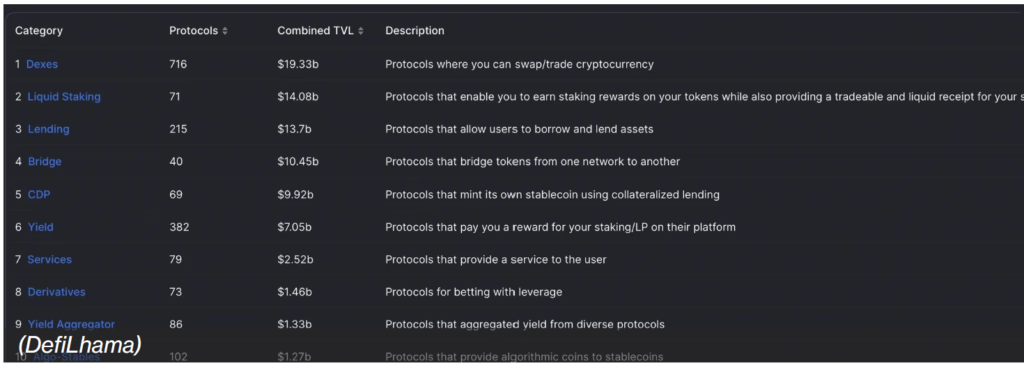

The total value of crypto assets deposited in liquid staking protocols was $14.1 billion as of European trading hours on Monday, making it the second-largest crypto market sector, according to data source DefiLlama. The total value locked in decentralized-finance (DeFi) lending and borrowing protocols was $13.7 billion, the third largest, while decentralized exchanges, with deposits of $19.4 billion, held the top spot.

The Ethereum blockchain’s upcoming Shanghai software upgrade, which will allow stakers to withdraw the ether (ETH) they have staked and the accumulated rewards for the first time, has galvanized investor interest in liquid staking. Liquid staking is the best-performing crypto sector this year, with growth in total value locked approaching 60%.

“It [the upgrade] will innovate the current space by allowing for healthy competition between liquid staking solutions, will strengthen ETH’s position by providing yield from staking/unstaking, and will give users the security of maintaining sovereignty over their assets,” Ryan Selkis, CEO of crypto research firm and data provider Messari, said in a newsletter published Friday.

By opening up to withdrawals, the upgrade is expected to improve overall liquidity. Since December 2020, more than 16.5 million ETH has been staked in Ethereum’s Beacon Chain, of which 42% has been locked through liquid staking protocols, mainly Lido.

Users of liquid staking protocols like Lido receive derivative tokens such as staked ether (stETH) on a 1:1 basis. These derivative tokens represent a user’s stake and can be used to generate additional yield across Defi protocols. Lido’s governance token LDO has rallied 220% this year, outperforming industry leaders bitcoin (BTC) and ether by a huge margin. Governance tokens of Lido’s rivals Rocket Pool and Frax have also surged, according to CoinDesk data.

Liquid staking’s increased popularity relative to decentralized lending could also be attributed to the yield differential between the two sectors.

Lido, which controls over 75% of the liquid staking market, offers an annualized percentage return of 4.8% on staked ether, 6% on staked solana and 6.3% on Polygon’s MATIC token. That’s higher than the rates available for lending top stablecoins USDT, USDC and DAI on the DeFi giant Aave.

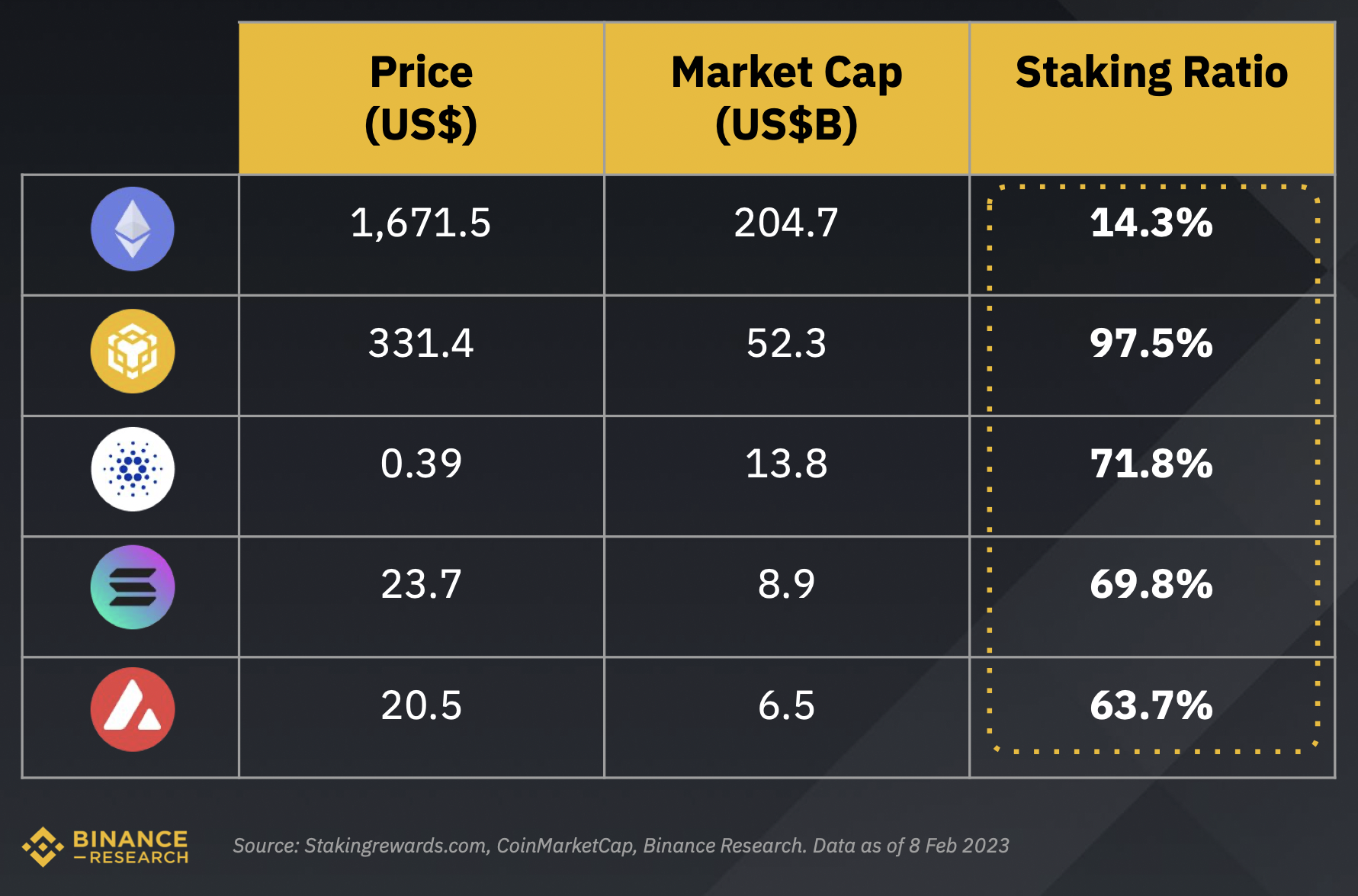

Liquid staking is expected to grow further, because the ETH staking ratio, which measures the percentage of the cryptocurrency’s supply staked, is significantly lower than other layer 1 cryptocurrencies.

“Only 14% of ETH is currently being staked vs. 58%, the average for layer 1 coins, Markus Thielen, head of research and strategy at digital-assets platform Matrixport, told CoinDesk. Its likely interest in staking will continue to swell.”

Binance Research recently voiced a similar opinion, forecasting more inflow of money into staking protocols after the Shanghai upgrade.

“It could be argued that many groups of individuals had been waiting for Shanghai to stake their ETH, as withdrawals will remove the liquidity risk and uncertainty of an previously undefined lock-up period,” Binance Research said in a report early this month.

BY: Omkar GodBole

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.