Here’s Why Artificial Intelligence Focused Cryptocurrencies Are Vastly Outperforming Bitcoin

Tokens utilizing AI technology have been on a tear in the past months. Some are sold on the hype, while some remain wary.

Crypto markets are known to be fueled by narratives, and artificial intelligence (AI) is the latest trend.

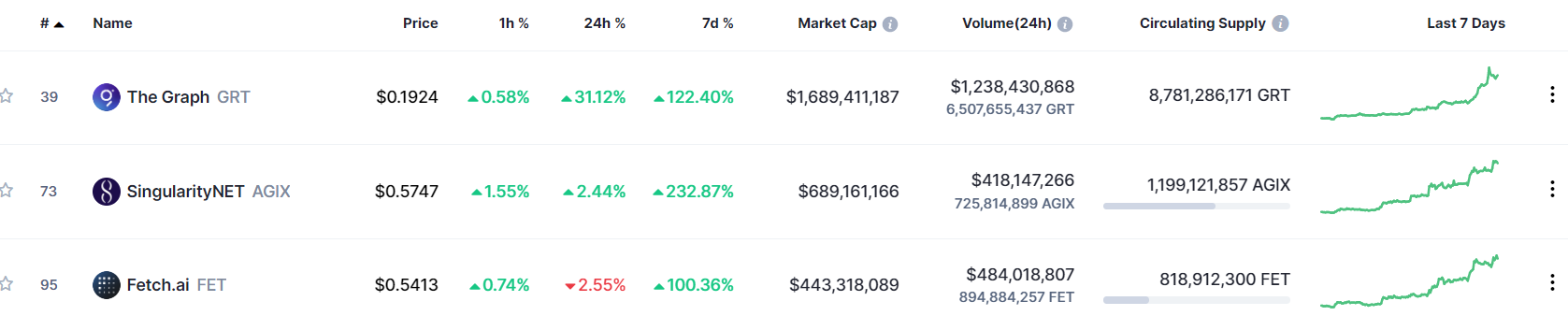

Prominent traders on Crypto Twitter are heralding AI-based tokens as the sector that might lead the next bull market cycle. They may be right so far: Such tokens are up an average of 80% in the past week alone, CryptoSlate data shows.

Among the biggest gainers have been tokens such as Artificial Liquid Intelligence (ALI), Fetch AI (FET) and Singularity Net (AGIX), which have surged as much as 220%, as CoinDesk previously reported.

The tokens of AI-based upstarts like Image Generation AI (IMGNAI) have more than tripled over a two-week period. The protocol allows users to generate artwork using text disruptions on social platforms such as Discord.

One-time popular tokens from 2018 and 2021, such as Big Data Protocol (BDP) and Measurable Data (MDT), seem to have jumped on the hype with tweets that seem to remind investors of how they utilize AI technology within their blockchain applications.

BDP has surged 2,100% in the past week, CoinGecko data shows, while MDT has jumped 150%. Both protocols use their tokens to commoditize data, allowing providers and buyers to exchange data securely and anonymously.

Crypto majors such as bitcoin and ether have paled in comparison, rising just 30% each in the past month despite fundamental catalysts. However, the market capitalization of major tokens is upward of $300 billion, meaning they require significant amounts of investment and public interest for prices to surge multifold within a few weeks.

Why are AI tokens surging?

AI broadly refers to the simulation of human intelligence in machines programmed to think and act like humans. Popular applications for this technology have so far been limited to chatbots, self-driving cars, optimizing search in online marketplaces, and image-generation software – but futuristic usecases envision wholly-autonomous cities, cyborg humankind and interstellar travel.

Much of the recent surge in AI tokens emerged after the public launch of chatbot ChatGPT and image generation software Dall E in mid-2022. Both are traditional software that do not use cryptocurrencies or blockchain and were launched by OpenAI, which recently raised $10 billion from Microsoft at a $29 billion valuation.

Such institutional interest has helped create a compelling argument for crypto traders to bet on AI-focused tokens as the next growth sector.

“The growth opportunity around the AI and Web3 space combines early interest, potential and hype,” states Ravindra Kumar, founder of crypto wallet Frontier. “While it’s true that there may be some hype surrounding AI intervention in the crypto space, we are seeing the emergence of innovative and compelling use cases.’

Aditya Khanduri, head of marketing at Biconomy, takes a milder approach: “I believe that the current AI trend is still pretty speculative, leading to a jump for tokens like OCEAN, ALI, AGIX. Some of the tokens with more buzz and followings have pumped and it’s less about the actual tech behind it.”

“This is because the current AI tokens and web3 projects may not yet know what these decentralized AI tools look like. There’s a lot of unanswered challenges and lots to be figured out,” Khanduri told CoinDesk in a recent chat.

The likes of Khanduri say token-based usage while scaling AI software is a hard problem to solve.

“Say an AI tool gets to 250 million users. Then what will its infra look like? How will people use it? How will the data be trained? Where does the token fit in? Can you even have a way to reward people for their data if you used it to train your models?” he said.

Meanwhile, some market watchers remain cautious about the AI token hype.

“Once the market starts livening up a bit, all sorts of new trends come out of the woodwork. And they are not all as solid as they might look,” financial market consultant Valentina Drofa told CoinDesk.

“There is a risk that this whole ‘new trend’ is going to end up in an empty hype, as there are many speculators that would seek to make use of short-term price pumps,” Drofa added, referring to the recent multifold gains put up by some tokens.

“The industry at large will end up dealing with the long-term fallout and another hit to its image. Such cycles are becoming rather tiresome and sad to observe again and again,” she stated.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.