FTX CEO Sam Bankman-Fried Denies Insolvency Rumors as Binance Liquidates FTT Token

The head of FTX sister company Alameda Research offered to buy as much FTT as Binance wants to sell.

As speculation mounted over the weekend about the solvency of billionaire Sam Bankman-Fried’s FTX crypto exchange, the FTX CEO tweeted early Monday morning that “FTX is fine. Assets are fine.”

“FTX has enough to cover all client holdings,” he added. “We don’t invest client assets (even in Treasurys). We have been processing all withdrawals, and will continue to be.”

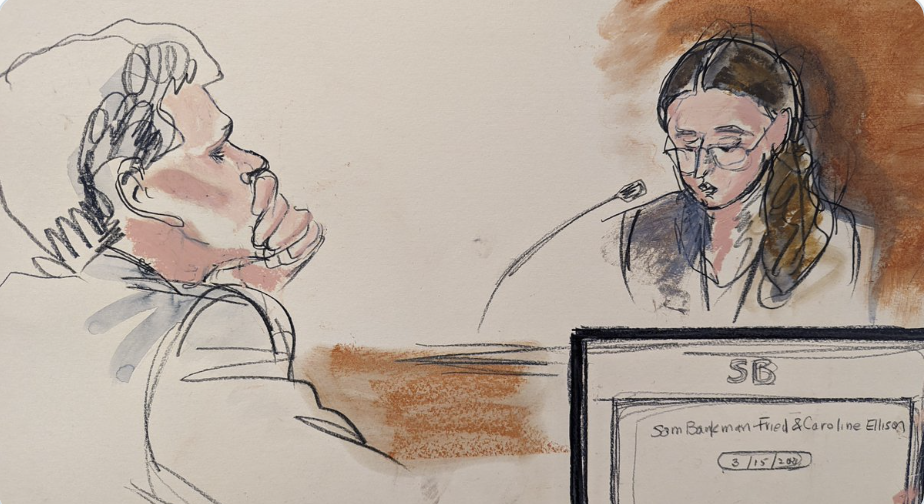

Last week, CoinDesk published a story revealing the balance sheet of FTX sister company Alameda Research was loaded with FTX’s native exchange token FTT. That led to a public war of words between Alameda CEO Caroline Ellison and Binance CEO Changpeng Zhao, also owner of a sizable number of FTT tokens.

Noting the revelations in that CoinDesk report, Zhao said his exchange would begin liquidating any remaining FTT it held on its books. Ellison fired back over Twitter, saying Alameda stood ready to purchase for $22 each (roughly the price at the time) any amount of FTT Binance wanted to unload.

In a tweet Monday afternoon, Zhao appeared to rebuff Ellison’s offer, saying Binance would “stay in the free market.”

“I’d love it if we could work together for the ecosystem,” Bankman-Fried said in his tweet on Monday, referring to Zhao.

The FTX token (FTT) was recently trading at $22.34, according to CoinDesk data. It is down 14% so far this month.

By: Oliver Knight

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.