First Mover: As Wall Street Goes Topsy-Turvy, Crypto Traders Are Bullish as Ever

As the coronavirus takes its devastating toll on the U.S. economy, financial pros are increasingly confounded by the markets.

The economy is in its worst shape since the early 20th century, and stocks are soaring. The U.S. government’s borrowing is expected to triple to a record $4.5 trillion this fiscal year, yet 10-year Treasury yields are close to historic lows.

A report Thursday showed that U.S. jobless claims fell to 963,000 last week, the first weekly figure below 1 million since March. But in the topsy-turvy logic of financial markets, the improvement was seen as neutral or even negative – since it might relieve pressure on authorities to speed up more trillion-dollar stimulus packages.

“The good news may be bad news now,” Chris Gaffney, president of world markets at TIAA Bank, told Bloomberg News.

Bank of America analyst Athanasios Vamvakidis acknowledged last week in a report that it was hard to tell if the dollar’s recent slide in foreign-exchange markets was due to ebullience over easy Federal Reserve monetary policies – or fears that the U.S. currency might be at risk of losing its status as the dominant world currency.

What’s striking is that, through it all, crypto traders have stayed almost unequivocally bullish.

Bitcoin is up 64% in 2020, more than double the gains for record-breaking gold. Prices for ether, the native token of the Ethereum blockchain, have tripled this year, thanks to the fast growth in decentralized finance, known as DeFi, and in digital “stablecoins” linked to U.S. dollars.

John Todaro, director of research at cryptocurrency analysis firm TradeBlock, noted in an email Thursday that the market value of 10 digital tokens associated with DeFi has quintupled this year to almost $10 billion.

Lennard Neo, head of research at Stack Funds, wrote Thursday in a report that bitcoin might do well in any of the currently plausible market scenarios: “Bitcoin could be a ‘risk-on hedging-type asset,’ where it performs relatively well in thriving markets, yet acting as a hedge to global uncertainties, displaying financial attributes that fall in between that of equity and gold.”

Trading volume on Mexico’s leading cryptocurrency exchange has quadrupled this year. The number of bitcoin “whales” holding at least 1,000 bitcoin tokens is at its highest since August 2017, according to CoinDesk’s Omkar Godbole.

Mentions are becoming more common in mainstream financial publications. The Financial Times reported Thursday that crypto hedge-fund managers have returned more than 50% through July, compared with the low-single-digit gains that hedge funds generated across traditional asset classes.

Barstool Sports president Dave Portnoy, who has gained a following this year for live-streaming profanity-laced trading sessions to millions of retail day traders, reportedly owns $1 million of bitcoin after meeting with the Winklevoss twins, founders of the Gemini cryptocurrency exchange.

It’s all become so bizarre that some cryptocurrency analysts acknowledge even they can’t really make heads or tails of the markets these days.

“Ultimately, when it comes to investing in this environment, the risk factor is through the roof,” Mati Greenspan, founder of the cryptocurrency research firm Quantum Economics, told subscribers Thursday. “All risk metrics and meters have long been broken, so we really need to approach all investments with extreme caution right now.”

That’s probably the safest interpretation.

Bitcoin Watch

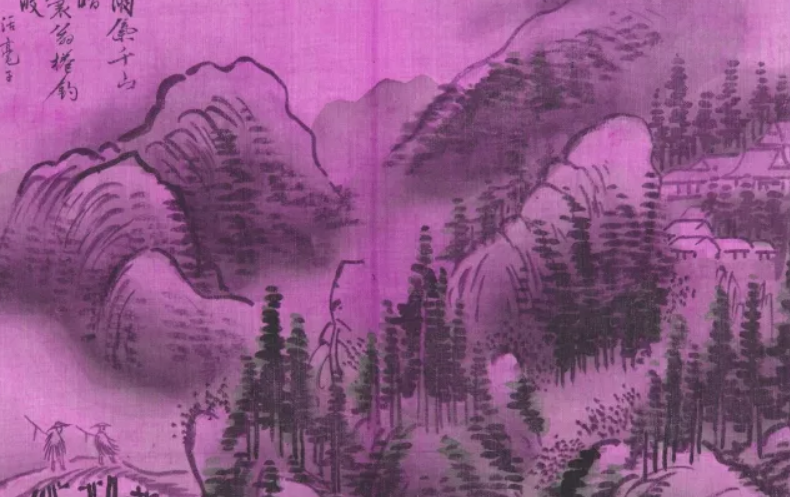

Bitcoin printed gains for the second straight day on Thursday, despite risk aversion in the stock markets. Even so, the immediate bias remains neutral, with the cryptocurrency still trapped in an ascending triangle (above left).

The current consolidation could end with a bullish breakout above $12,000, as ether, the second-largest cryptocurrency, has jumped to fresh multi-month highs, confirming a bull flag breakout, or a bullish continuation pattern on its daily chart. That could be taken as a positive signal for bitcoin, as ether has recently led the market higher with its DeFi-led price rally.

Supporting the case for the bullish breakout in bitcoin is the recent surge in institutional participation. Open interest in futures listed on the Chicago Mercantile Exchange (CME) rose to a record high of $841 million earlier this week and is up by over 100% over the last four weeks, according to data source Skew.

A triangle breakout, if confirmed, would shift the focus to resistance at $12,325 (August 2019 high). The short-term outlook would turn bearish if buyers fail to defend the lower end of the triangle, currently at $11,280. That could encourage selling and lead to a deeper decline toward the Aug. 2 low of $10,659.

Responses