Ether Tops $2.4K as Cathie Wood’s Ark, 21Shares Amend Spot ETH ETF Filing

The updated prospectus brings the spot Ethereum ETF application more “in line” with the recently approved spot BTC ETF prospectus, one analyst noted.

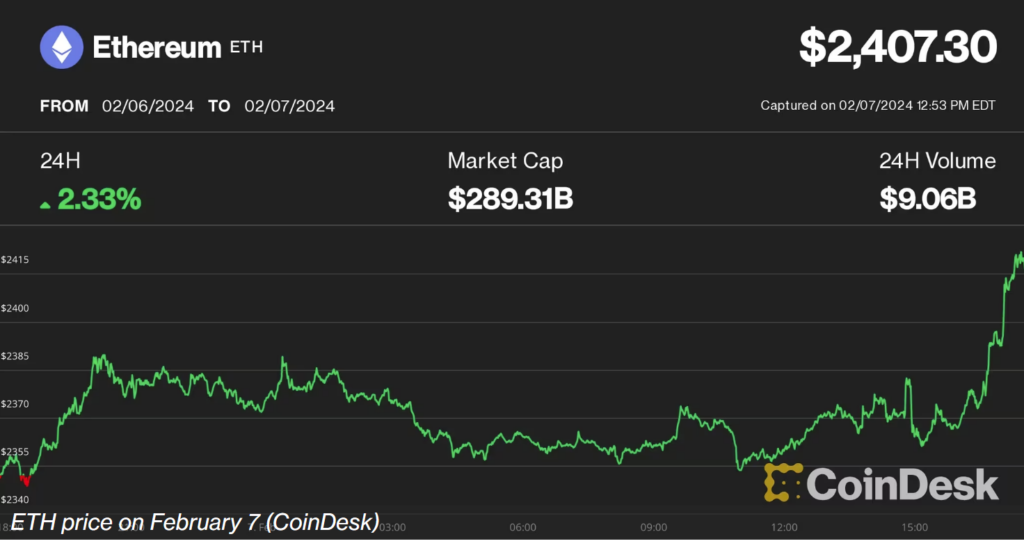

Ethereum’s native token ether (ETH) jumped above $2,400 Wednesday afternoon to a two-week high as asset managers Ark Invest and 21Shares amended their joint spot ETH exchange-traded fund (ETF) filing.

The updated S-1 paperwork filed Wednesday with the U.S. Securities and Exchange Commission (SEC) shows that the ETF would feature a cash creation and redemption mechanism, which that regulatory agency favored for spot bitcoin ETFs that were approved in January.

“Looks like they updated to be only cash creations and some other things that bring it in line with the recently approved spot BTC ETF prospectus,” Eric Balchunas, senior ETF analyst at Bloomberg Intelligence, noted in an X post.

The document also added a section about possibly staking ether through “one or more trusted third party staking providers,” opening the possibility for the fund to lock up some of its holdings and earn rewards.

ETH’s price advanced nearly 2% within an hour from when the news appeared, breaking above $2,400 for the first time since January 22. The second-largest crypto by market cap was up 2.4% over the past 24 hours and outperformed the broader cryptocurrency market, with the CoinDesk 20 (CD20) index that tracks the largest digital assets being up 1.2% and BTC gaining 0.4%.

BY: Krisztian Sandor

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is an award-winning media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. In November 2023, CoinDesk was acquired by Bullish group, owner of Bullish, a regulated, institutional digital assets exchange. Bullish group is majority owned by Block.one; both groups have interests in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin. CoinDesk operates as an independent subsidiary, and an editorial committee, chaired by a former editor-in-chief of The Wall Street Journal, is being formed to support journalistic integrity.

Edited by Stephen Alpher.