Crypto Daybook Americas: Bitcoin Defies Peak Fear as U.S. Dollar Plunges Over Trump’s China Trade War

As the trade war between the U.S. and China escalates, with the latter raising tariffs on the former from 84% to 125% this morning, bitcoin (BTC) and the wider cryptocurrency market appear relatively unfazed.

Bitcoin is down a mere 0.15% over the last 24 hours, and China’s recent escalation hasn’t stopped its ongoing recovery. The cryptocurrency is now trading above $82,000. The wider crypto market, measured by the CoinDesk 20 (CD20) index, is stable with similar performance.

The same can’t be said about other assets. Gold rose to a new $3,227.5 record making Tether’s XAUT — a gold-backed cryptocurrency — the top-performing digital asset. Meanwhile, the U.S. Dollar Index (DXY) dropped below 100 after enduring its biggest drop since 2022. At the same time, the yield on 10-year Treasuries kept rising to now stand near 4.4%.

“The question of a potential dollar confidence crisis has now been definitively answered — we are experiencing one in full force,” ING strategists, including Francesco Pesole wrote in a note reported on by The Telegraph.

Inflation in the U.S. actually declined at the headline level last month, which could prompt the Federal Reserve to resume cutting rates at its next meeting. Still, the market may have interpreted the lower figures as potentially waning demand, deepening the crisis.

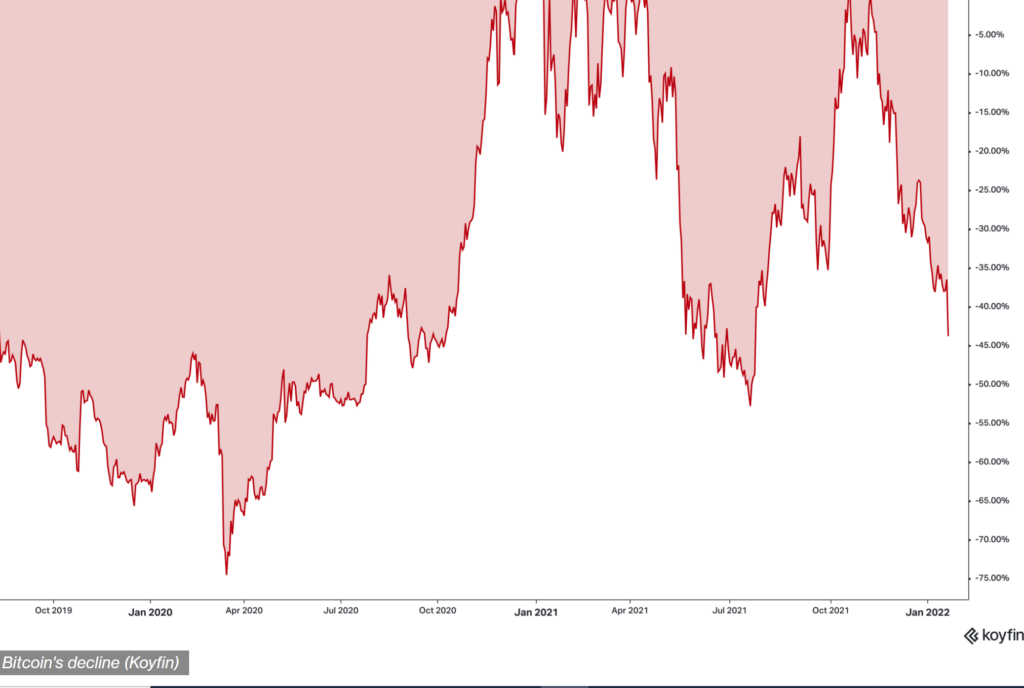

That “confidence crisis” is seemingly seeing every asset gain against the dollar, except crypto. Bitcoin investors realized losses of up to $250 million over 6-hour windows during the recent drop, according to Glassnode, which points out that “realized losses are shrinking – suggesting early signs of seller exhaustion.” Stay alert!

BY: Francisco Rodrigues, Shaurya Malwa, Oliver Knight|Edited by Aoyon Ashraf

DISCLOSURE & POLICES

CoinDesk is an award-winning media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of editorial policies. CoinDesk has adopted a set of principles aimed at ensuring the integrity, editorial independence and freedom from bias of its publications. CoinDesk is part of the Bullish group, which owns and invests in digital asset businesses and digital assets. CoinDesk employees, including journalists, may receive Bullish group equity-based compensation. Bullish was incubated by technology investor Block.one.