Block Demand Leads to Fee Spike as Bitcoin-Based Meme Coins Flourish

Over 11,000 tokens have been issued and traded on the Bitcoin network, data shows.

Fees on the Bitcoin blockchain have surged to two-year highs as the ‘Bitcoin Request for Comment’ (BRC-20) tokens and the rising popularity of the Ordinals protocol drives demand for block space.

Average transaction fees on the Bitcoin network were hovering at just under $20 during European hours on Monday, a bump from last week’s average $1.20 level. Such levels were previously seen in May 2021, when bitcoin prices set a then-record peak of $60,000.

The number of non-fungible tokens (NFT) tied to the Bitcoin blockchain surged above 3 million last week after a one-day spike in activity that mainly consisted of text-based assets, data from Dune Analytics showed.

The tokens, called inscriptions, function on the Ordinals Protocol. Ordinals allows users to embed data into the Bitcoin blockchain by inscribing references to digital art into small bitcoin (BTC)-based transactions.

The BRC-20 token standard allows users to issue transferable tokens directly through the network – which has spurred a collection of digital artwork and meme tokens built on Bitcoin.

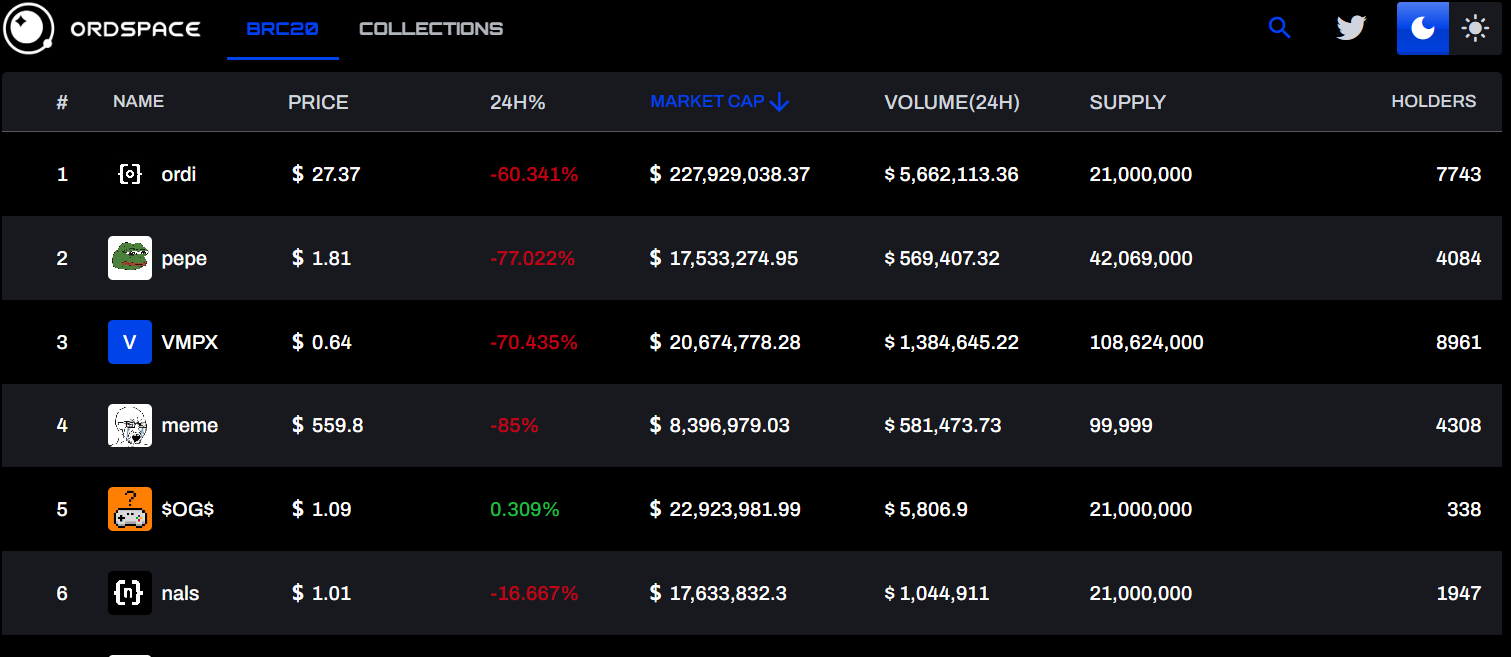

Data from OrdSpace, which tracks BRC-20 data, shows over 11,000 tokens issued on Bitcoin are available on the open market as of Monday with a cumulative market capitalization of $1.6 billion.

So far, tokens of Ordinals marketplace Ordi (ORDI) are the most valued BRC-20 tokens with a market capitalization of $220 million and 7,300 unique ordi token holders. Ordi is said to be the first BRC-20 token deployed on Bitcoin, which may also be aiding its value proposition among holders.

Pepe tokens on Bitcoin – different from the ones issued on Ethereum – are the second-largest BRC-20 issuance, albeit with a relatively tinier $17 million market capitalization.

Meanwhile, some analysts consider the rapid transactional activity as a sign of network adoption which adds to Bitcoin’s fundamental narrative.

“During the last peak in 2019, most Bitcoin transactions skewed towards larger transactions, in the range of $1,000 to $10,000,” said Tom Rodgers, Head of Research at ETC Group, in an email to CoinDesk.

“This suggests most Bitcoin users were using the blockchain for trading. Compare this to today. The largest cohort of Bitcoin transactions – 359,560 – came from transactions under $1. This suggests a huge increase in Bitcoin velocity — or the amount of Bitcoin being transacted by users, instead of being locked up in cold wallets and held over the long term,” Rodgers added.

While adoption has been brisk, the network congestion has briefly caused problems at crypto exchanges such as Binance, which paused bitcoin withdrawals twice over the weekend.

As such, on-chain data shows that there are nearly 415,000 unconfirmed Bitcoin transactions at writing time on Monday, which is higher than anything seen during the bull runs of 2018 and 2021.

BY: Shaurya Malwa

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.