Bitcoin’s ‘Taker Buy-Sell Ratio’ Surges, Signals Renewed Bullish Vigor

The ratio shows more optimism at $29,000.

Bitcoin’s (BTC) “taker buy-sell ratio” recently surged on several crypto exchanges, signaling a renewed bullish sentiment at around $29,000.

The ratio surged to 1.36 on Aug. 1 on Bybit, reaching its highest level in at least a year, according to data tracked by South Korea-based blockchain analytics firm CryptoQuant. Values above 1 indicate that takers’ buy volume is outpacing the sell volume, a sign of bullish trading in the market. Bybit is the world’s third-largest crypto perpetual futures exchange in open interest and trading volume.

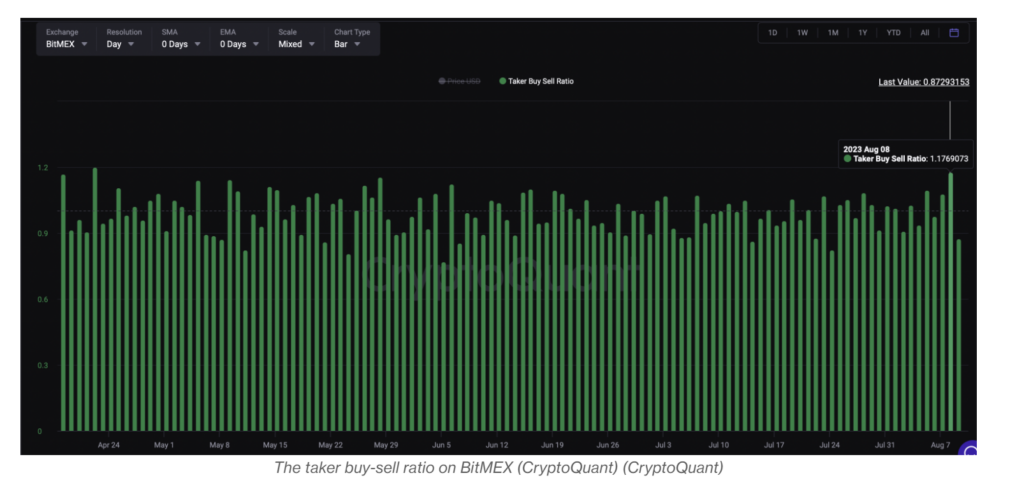

The ratio hit a three-and-a-half-month high of 1.17 on crypto exchange BitMEX on Tuesday and a six-month high of 1.31 on OKX, another trading platform, on July 30.

The taker buy-sell ratio is the ratio of buy volume divided by the sell volume of takers in perpetual swap markets. Perpetual swaps are futures-like derivative contracts with no expiration date, allowing traders to speculate on the value of the underlying asset.

Market takers are entities that put orders to buy or sell securities immediately, taking out liquidity from the order book. Trading firms and individual investors fall into the category of takers. Meanwhile, entities in the business of creating order book liquidity are market makers.

The data explains the recent bear failure to keep bitcoin below $29,000.

Since July, bitcoin has chalked out multiple daily candles with long lower wicks, indicating brief periods of sub-$29,000 trading. Prices jumped over 2% on Tuesday, topping the $30,000 mark.

According to CryptoQuant CEO Ki Young Ju, a spike in taker buy-sell ratio on low-volume exchanges like BitMEX is often a sign of increased buying by whales or large investors.

“Bitcoin whales opened giga longs at $29,000,” Ju tweeted Tuesday, referring the taker buy-sell ratio.

BY: Omkar Godbole

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.