Bitcoin Market Sentiment Is Most Bullish in 14 Months With US Jobs Report Due

The cost of holding a bullish long position in perpetual futures tied to bitcoin has jumped to the highest since the dizzy bull market days of late 2021.

Bitcoin (BTC) is currently priced significantly lower than it was in late 2021. Still, the mood in the market is as positive as it was back then.

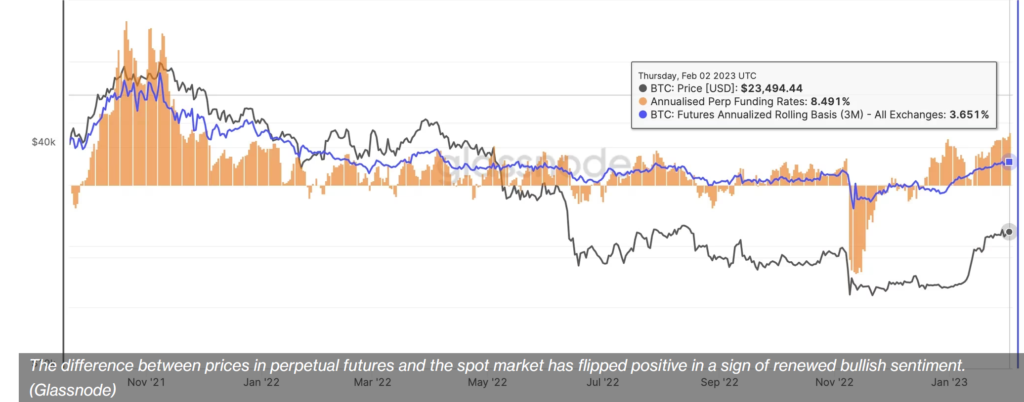

That’s the message from funding rates, a mechanism that keeps the prices of bitcoin perpetual futures contracts in sync with the spot market price. When perpetual futures are trading above spot, the funding rate is positive and holders of bullish long, or buy, positions pay bearish shorts to keep their trade open. The opposite happens when perpetuals trade below the spot price.

Analysts track the funding rate to gauge the mood of leverage traders. The higher the funding rate, the more excited traders are about price prospects and the more willing to pay a premium to keep their upside bets open.

As of Thursday, the annualized bitcoin perpetual funding rates across major exchanges including Binance was 8.491%, the highest since Dec. 3, 2021, according to data tracked by blockchain analytics firm Glassnode.

Back then, one bitcoin was priced around $57,000 or 2.5 times the current market rate of $23,400. The cryptocurrency set a record high of $69,000 in November 2021.

The funding rate flipped positive in mid-December last year, indicating seller exhaustion. The cryptocurrency picked up a strong bid at the turn of the year and has rallied over 40% since then.

“There has been a clear shift in market sentiment post-[December) CPI with funding rates well into positive territory and price volatility on the rise,” Dessislava Laneva, a research analyst at Paris-based crypto data provider Kaiko, said in a tweet referring to the U.S. consumer price index.

The CPI fell to 6.5% in December, the sixth straight monthly deceleration in price increases. The data convinced markets that the Federal Reserve (Fed) was likely to pivot to liquidity-boosting interest rate cuts later this year.

Early this week, the Fed chair Jerome Powell acknowledged the inflation picture and downplayed concerns of a severe tightening-induced economic slowdown, bolstering the pivot hopes.

Focus on U.S. nonfarm payrolls

The U.S. nonfarm payrolls (NFP) report scheduled for release at 13:30 UTC is likely to show the world’s biggest economy added 185,000 jobs in January following December’s 223,000 increase, according to Reuters estimates sourced from FXStreet.

The unemployment rate is forecast to tick slightly higher to 3.6% in January, while average hourly earnings, or wage growth, is expected to print at 4.9% year-on-year following December’s 4.6% rise.

A notable increase in average hourly earnings, a proxy for potential inflation, coupled with the headline jobs figure might see investors reconsider the possibility of the Fed keeping interest rates higher for longer and scale back bullish positioning in risk assets, including cryptocurrencies.

BY: Omkar GodBole

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.