Bitcoin Climbs Above $22K as Powell Softens Tone on Day 2 of Congressional Testimony

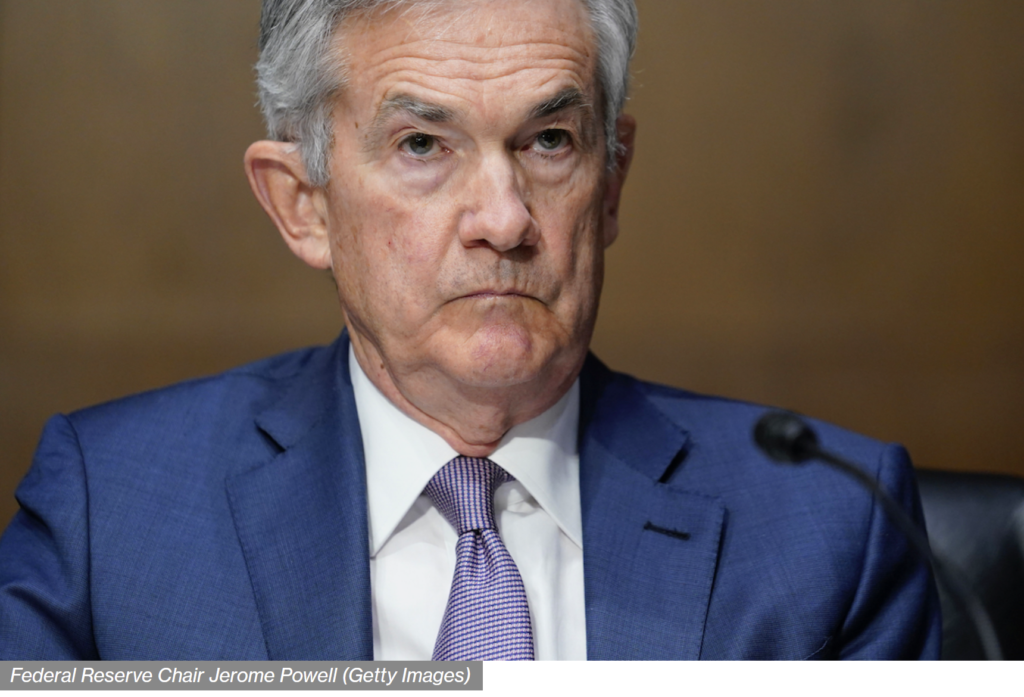

The Fed chair said no decision has yet been made on the size of the coming March rate hike.

U.S. Federal Reserve Chairman Jerome Powell “stressed” that the central bank has yet to make a decision on the size of the rate hike when the Federal Open Market Committee (FOMC) meets later in March.

Testifying before the House Financial Services Committee for his semi-annual monetary policy report on Wednesday, Powell made a notable change (from Tuesday’s Senate testimony) in his prepared remarks. “I stress that no decision has been made on this,” Powell added today, when talking about the pace of rate hikes.

Markets on Tuesday took Powell’s prepared remarks as suggesting the Fed was likely to hike rates 50 basis points at its March meeting instead of the previously assumed 25. Bitcoin and stocks both saw sizable declines and the dollar a powerful rally following the testimony. The insertion of the “no decision” wording this morning could be an attempt to soothe those hawkish fears.

Bitcoin (BTC) bounced more than $200 on the news, now back above $22,000 at $22,200, and the S&P 500 moved from a modest loss to a modest gain. The dollar is giving back some Monday’s sizable advance.

Powell reminded that there’s a number of important economic reports between now and the FOMC’s March 21-22 meeting – this Friday’s February payrolls report and next week’s inflation figures among them – and the incoming data will play an important role in guiding the rate decision.

BY: Stephen Alpher

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.