XRP Replaces Tether as 3rd-Largest Cryptocurrency While BTC Faces $384M Sell Wall

XRP has surged more than 20% in 24 hours, leapfrogging Tether’s USDT.

XRP (XRP) is on a tear as bitcoin (BTC) struggles to approach $100,000 amid talk of a large “sell wall” near the six-digit price mark.

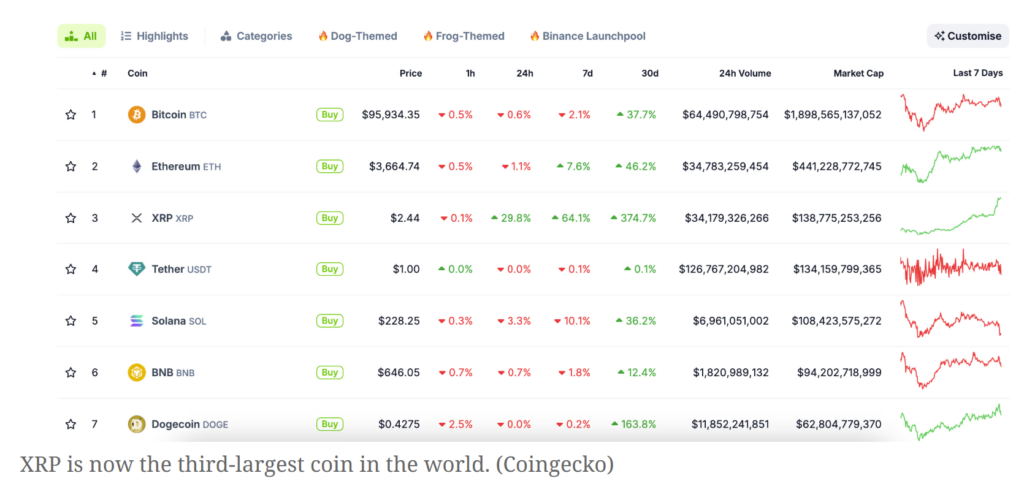

XRP, the payments-focused cryptocurrency, has skyrocketed 375% to $2.40 in 30 days. The price has surged more than 20% in the past 24 hours alone, CoinDesk data show.

The meteoric rise has lifted the cryptocurrency’s market capitalization to $139 billion, replacing the leading dollar-pegged stablecoin, Tether’s USDT, as the world’s third-largest digital asset.

“This [XRP] comeback is making waves across the market, potentially signalling the return of retail traders and investors to the crypto market,” Mena Theodorou, co-founder of the crypto exchange Coinstash, said in an email. “Recent XRP trends on TikTok, speculation about the approval of a Ripple-issued stablecoin, and the possibility of an ETF are likely fueling the fire and driving renewed interest in XRP.”

XRP’s trading volumes have surged globally. Upbit, South Korea’s biggest crypto exchange, registered a record $4 billion volume in the XRP-won pair in the past 24 hours. That’s over 27% of the exchange’s total trading volume, according to data source Coingecko.

The record activity in the XRP market comes as South Korea’s Democratic Party, on Sunday, backtracked on a plan to impose crypto capital gains tax in 2025, delaying it by two years.

“Originally planned for 2021, the tax has now been postponed multiple times,” Markus Thielen, founder of 10x Research, said in a note to clients Monday. “This delay is critical, as it effectively removes a major obstacle to speculative trading, giving the green light for another wave of aggressive crypto speculation.”

BTC’s sell wall

Bitcoin, the leading cryptocurrency by market value, started the new week on a weak note, dropping 1% to $96,000. Prices have remained locked between $90,000 and $100,000 for the past two weeks, with upward momentum consistently faltering near the elusive six-digit mark.

Continued appreciation warrants bullish flows strong enough to chew through a stack of sell orders worth $384 million, according to Valentin Fournier, an analyst at BRN.

“Despite strong market catalysts and growing investor confidence, Bitcoin continues to struggle with the $100K psychological barrier. Profit-taking is evident, and a substantial sell wall of over 4,000 BTC must be cleared before higher levels are achievable,” Fournier told CoinDesk in an email.

Moreover, traders are increasingly rotating money out of bitcoin and into other cryptocurrencies. That’s evident from the decline in BTC’s dominance rate, or share of the crypto market, from 61.5% to 56.5% since Nov. 21.

“Bitcoin dominance has dropped by 5% over the past 12 days, breaking below the positive trendline established in June 2023. With significant resistance at $100K, the market is seeing a capital shift towards altcoins, supported by increasing liquidity,” Fournier said.

BY: Omkar Godbole

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information have been updated.

CoinDesk is an award-winning media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of editorial policies. CoinDesk has adopted a set of principles aimed at ensuring the integrity, editorial independence and freedom from bias of its publications. CoinDesk is part of the Bullish group, which owns and invests in digital asset businesses and digital assets. CoinDesk employees, including journalists, may receive Bullish group equity-based compensation. Bullish was incubated by technology investor Block.one.