Weekly Report: Bitcoin ETF, Blackrock Interest and Coinbase Listings

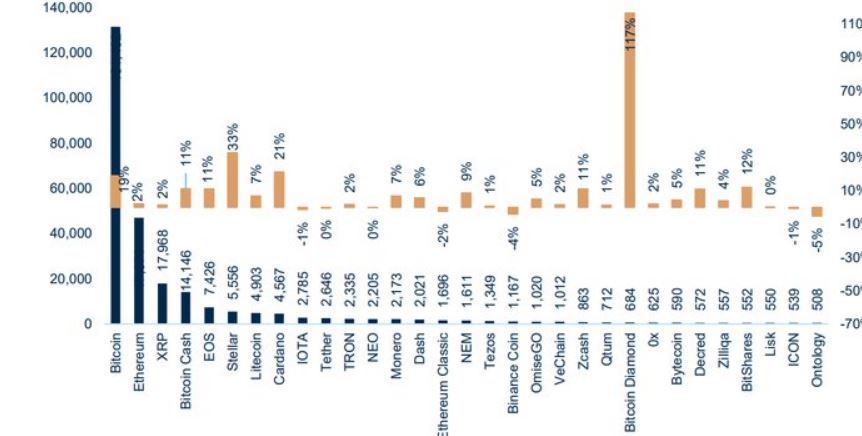

The Bitcoin dominance increased from 42.7% to 45.6%, moving up due to Bitcoin’s increased trading activity and 19% price appreciation over the course of a week. The best performers among the top-40 crypto assets were Bitcoin Diamond (+117%), Stellar (+33%), and Cardano (+21%). It was a good week as further names were added into Coinbase’s list to be potentially accepted for trading. Positive regulatory news, the upcoming Bitcoin ETF announcment and Blackrocks crypto working group have contributed to the bullish sentiment.

Cryptocurrency Regulatory Updates

Ukrainian authorities support regulatory concept for cryptocurrencies

The Financial Stability Council of Ukraine has supported a crypto regulation concept, according to a social media post. The regulation concept involves recognizing cryptocurrencies and tokens as financial instruments, licencing of transaction participants, defining information disclousure conditions and more. The concept was suggested in May 2018. There were several versions of crypto-concepts, according to our sources in the Ukrainian crypto sector, however which one will be accepted as a final document is still unclear.

RBI to Supreme Court message is to regulate Bitcoin

The Reserve Bank of India (RBI) told the Supreme Court that it is necessary to regulate bitcoin and other cryptocurrencies in India, according to The Financial Express. It may encourage illegal transactions and impact international flow of funds, according to an RBI official. The interdisciplinary committee under the secretary of economic affairs in the finance ministry was set up last year to examine virtual currencies, and has to provide its report on regulatory framework for cryptocurrencies. The RBI will need three weeks to respond to multiple petitions on the regulations. The Supreme Court postponed the final hearing on the RBI’s ban on crypto trading until 11th September 2018.

EU Parliament study says CB digital currencies will reshape the competition in crypto market

A study by the EU Parliament on competition in the area of FinTech said that the creation of cryptocurrencies promoted by banks, including central banks, will reshape the current competition in the cryptocurrency market, broadening the number of competitiors. The EU Fifth Anti-Money Laundering Directive came into force on 9th July. It set a new legal framework for the EU regulator to deal with digital currencies, in order to protect against money laundering and terrorist financing, setting stricter transparency requirements.

Cryptocurrency Market Updates

Stellar received Sharia compliance certificate for payments and asset tokenization

Stellar reported that it obtained a Sharia compliance certification for the Stellar technology and network to provide payments and asset tokenization. The Shariyah Review Bureau (SRB), an international Sharia advisory agency licenced by the Central Bank of Bahrain, “has reviewed the properties and applications of Stellar and has promulgated guidance and guidelines that enable Sharia compliance applications of Stellar technology in Islamic financial institutions”, according to the Stellar blog. The Sharia compliance certification extends to applications and usages of lumens (XLM). The certification may help Stellar to win attention in countries where financial services require them to comply with Islamic financial principles, including Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, UAE, Indonesia and Malaysia. The Stellar Development Foundation representatives plan to meet leading financial institutions to present Stellar and how to best utilize Stellar in their Sharia-compliant financial services and products.

Grayscale reports 56% of investments were coming from institutional investors in 1H18

Grayscale Investments, one of the first investment vehicles bringing crypto investments infrastructure to the market, reported total investments into its products reached $248.4m as of end 1H18. The average weekly investments were $9.55m, including $6.05m into Bitcoin Investment Trust. Bitcoin investment products represent 63% of total assets raised. Other investment trusts are focused on Ethereum, Zcash, Ethereum Classic, Digital Large Caps, Bitcoin Cash, and XRP. The investor base of Grayscale Trusts includes 56% institutional investors, 20% accredited individuals, 16% retirement accounts, 8% family offices. The average investment was $848k for institutional investors, $553k for family offices, $335k for retirement accounts, and $289k for individuals. 64% of all new investments came from the US, 26% from offshore investors(Cayman-domiciled entities), and 10% from investors in other regions of the world.

BlackRock may potentially enter Bitcoin products market

BlackRock, the largest global ETF provider and one of the largest asset managers with over $6.3trln under management, announced the creation of a working group to assess potental involvement in Bitcoin, according to Financial News. BlackRock, previously negative about cryptocurrencies, may consider offering Bitcoin futures and other products to clients, subject to an investigation of the market.

Asian asset manager to launch crypto-custody solution

The Asian asset manager Fusang Investment Office, who focus on family offices, plan to launch a cryptocustody service Fusang Vault in Hong Kong. The service is expected to launch in 4Q18. The independently provided service can hold assets on behalf of the clients, and audit these assets periodically.

Bitcoin Diamond listed on HitBTC

Bitcoin Diamond surged over 100% during the last week after the news about listing on HitBTC. Bitcoin Diamond (BCD) is a fork of Bitcoin with implemented lightning and minimal transaction fees, and a ten times larger coin supply compared to bitcoin. The Bitcoin Diamond Foundation introduced plans to launch the BCD International Marketplace that will allow users to order and purchase products from popular online marketplaces such as Amazon, eBay, Etsy and AliExpress on a single platform powered by Bitcoin Diamond. The token started trading in March 2018. BCD developers tested the stability and reliability of the network and their testnet by creating payment channels and nodes. BCD is rebuilding the ZapWalletTxes, adding more functions and improving its features.

Schnorr Signatures the bext big change in Bitcoin

Peiter Wuille, one of the most influential Bitcoin developers, unveiled a draft which outlines technological structure promising to address the biggest problems affecting Bitcoin today – scalability and privacy. Simply put, Schnorr signatures are essentially an aggregation of the signature data required for a Bitcoin transaction and it’s predicted to help increase the capacity of the Bitcoin network by at least 25% as this approach will create more space in the block. Although updates and changes are being made on a daily basis, the Schnorr signatures are the biggest change in Bitcoin blockchain since SegWit as this impacts on the most important rules in Bitcoin.

Ethereum off-chain payment channel Raiden launches second Testnet

According to an announcement, Raiden sees its second testnet as an opportunity to fix some minor issues and remaining bugs before the mainnet release. The Raiden Network is a state channel off-chain scaling solution, enabling near-instant, low-fee and scalable payments on top of the Ethereum blockchain. Founder of Ethereum, Vitalik Buterin sees state channels as “an important technology that has the potential to greatly improve the scalability and privacy of many categories of blockchain applications.”

IBM partners with Columbia University to launch Blockchain Research Center

Tech giant IBM has partnered with New York-based Columbia University to develop a blockchain research center with the aim of accelerating innovation and data transparency in the Blockchain ecosystem. “With Columbia, we are able to bring together leading thinkers on applying blockchain and data best practices based on extensive research and business experience and together prepare a new generation of technologists and business leaders,” as director of IBM Research, Arvind Krishna commented. IBM is building very strong roots across the blockchain sector, last week the company, in collaboration with giant banks like HSBC, Deutsche Bank and Rabobank, conducted a series of blockchain-powered bank transfers, and also announced their backing of a Stronghold USD, which is a direct competitor to several stable coins.

Neufund, Binance and Malta Stock Exchange partners for Stock Exchange

Berlin-based Equity Token Offering (ETO) platform Neufund has announced its partnership with the Malta Stock Exchange (MSE) and leading cryptocurrency exchange Binance in launching a new fully regulated and decentralized stock exchange for trading and listing tokenized securities as well as crypto assets. Zoe Adamowicz, CEO and co-founder of Neufund, commented that “It is the first time in history that security tokens can be offered and traded in a legally binding way.” Malta has recently passed the DLT/Blockchain bills which help innovative companies from the sector to grow more easily.

TSMC sees Crypto Mining Cool off in Q3

Taiwan Semiconductor Manufacturing Comapny (TSMC), a chip manufacturing giant, has reported quarterly results with a total revenue of $7.85 billion. In a statement, TSMC CFO, Lora Ho said, “Our second-quarter business was mainly impacted by the mobile product seasonality, while continuing strong demand from cryptocurrency mining and more favorable currency exchange rate moderated with mobile softness.“ She did however add a brief projection for Q3 where she sees demand for chips from crypto miners softening in the third quarter due to weaker prices of crypto. “Moving into the third quarter of 2018, we anticipate our business will benefit from new product launches while cryptocurrency mining demand will decrease from the second quarter.”

Study Rings Alarm Bells on some the Biggest ICOs

An excellent paper from Penn Law School professors Cohney, Hoffman, Sklaroff and Wishnick on detailed analysis of the inner workings of Initial Coin Offerings, has analyzed White Papers and additional documentation of the 50 biggest ICOs of 2017. The team then analyzed how the projects’ software code reflects what is promised. The study reveals some interesting facts, which are summarized in a tweet or there is a 100 page report – Coin-Operated Capitalism.

Responses