The technician who called the 2020 market bottom says a ‘shocking rally’ is in store

Critical information for the U.S. trading day

It’s been a terrible week in an awful year for the stock market.

Walmart WMT, +0.04%, Target TGT, +1.24%, and Tencent 700, +3.53% each reported disappointing results to add fuel to the worries about interest-rate hikes and quantitative tightening. But, Melvin Capital aside, there haven’t been signs of capitulation.

Over the last six weeks, equity redemptions have totaled $46 billion, versus $91 billion when the COVID outbreak first became apparent, according to Sean Darby, chief equity strategist at Jefferies. So you could see the argument on why markets may not have plumbed their depths.

Noted technician Tom DeMark, who called the bottom in 2020 after COVID emerged, disagrees. The founder of DeMark Analytics — known for advising hedge fund managers like Paul Tudor Jones and Steven Cohen — told Fundstrat’s head of technical strategy Mark Newton that key markets are on the verge of reversing.

DeMark’s indicators are designed for anticipating turning points, to find overextended price moves, in either direction, that reverse.

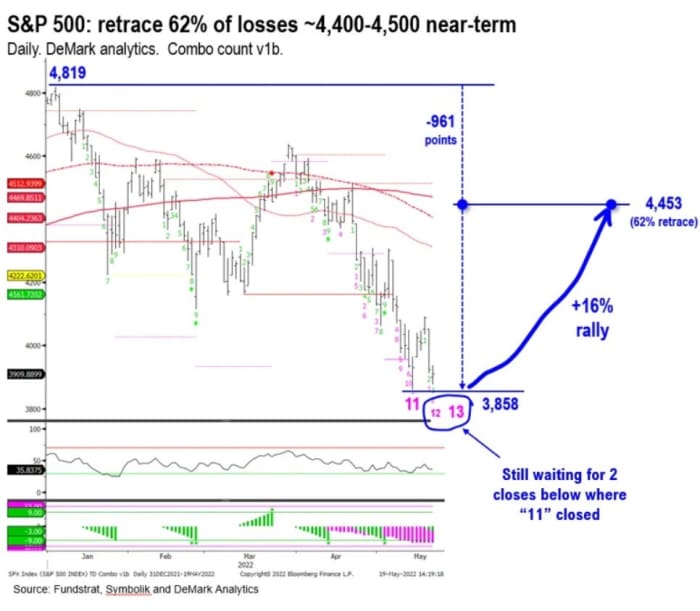

The S&P 500 SPX, 0.01%, DeMark says, will see one more sell-off, with a close below 3,863, before a “shocking rally” lifts the index between 4,400 and 4,500. The 10-year TMUBMUSD10Y, 2.791% will make one more high before peaking, and crude oil CL.1, +0.44% will make a top within four trading days — $117.29 per barrel, he forecasts — before turning lower.

The fundamental implications, if he’s correct, would be that the inflationary drivers of energy and commodities are peaking, which would put less pressure on inflation.

The buzz

Friday’s session features the expiration of key options contracts that could add volatility.

The People’s Bank of China lowered the rate that is used for home mortgages in the country to 4.45% from 4.6%.

Ross Stores ROST, -22.47% joined the retail Armageddon by reporting a 7% drop in same-store sales. Besides flagging sales, the retailer also pointed out the impact of higher transportation and labor costs.

Chip-equipment maker Applied Materials AMAT, -3.86% reported a worse than forecast profit and gave a disappointing outlook. Cybersecurity firm Palo Alto Networks PANW, +9.70% however hiked guidance for a third time.

SpaceX paid $250,000 to settle a sexual misconduct claim against its chief executive, Elon Musk, according to a report in Business Insider. Musk, also the chief executive of Tesla TSLA, -6.42% and bidder for Twitter TWTR, +2.65%, told the publication the story was a hit piece, and later tweeted that the accusations are untrue.

President Joe Biden started a trip to Asia with a visit to a Samsung Electronics factory in South Korea, which has machines built by Lam LRCX, +0.42% and KLA KLAC, -0.90%.

The markets

U.S. stock futures pointed to a strong open, with futures on the Dow Jones Industrial Average YM00, -0.08% rising around 250 points.

The yield on the 10-year Treasury TMUBMUSD10Y, 2.791% was 2.85%.

Top tickers

Here were the most active stock-market tickers as of 6 a.m. Eastern.

| Ticker | Security name |

| TSLA, -6.42% | Tesla |

| GME, -3.35% | GameStop |

| AMC, -8.03% | AMC Entertainment |

| NIO, -1.26% | Nio |

| AAPL, +0.17% | Apple |

| TWTR, +2.65% | |

| AMZN, +0.25% | Amazon.com |

| NVDA, -2.51% | Nvidia |

| BBIG, +3.96% | Vinco Ventures |

| AMD, -3.28% | Advanced Micro Devices |

BY: Steve Goldstein