SEC Calls FTT Exchange Token a Security

The complaint against Alameda’s Caroline Ellison and FTX’s Gary Wang contains allegations that FTX’s exchange token, FTT, constitutes an investment contract.

FTX’s exchange token FTT was sold as an investment contract and thus is a “security,” the U.S. Securities and Exchange Commission said in a complaint filed late Wednesday, in a move that is sure to have a wide-ranging impact on the industry.

“If demand for trading on the FTX platform increased, demand for the FTT token could increase, such that any price increase in FTT would benefit holders of FTT equally and in direct proportion to their FTT holdings,” the SEC wrote in its complaint. “The large allocation of tokens to FTX incentivized the FTX management team to take steps to attract more users onto the trading platform and, therefore, increase demand for, and increase the trading price of, the FTT token.”

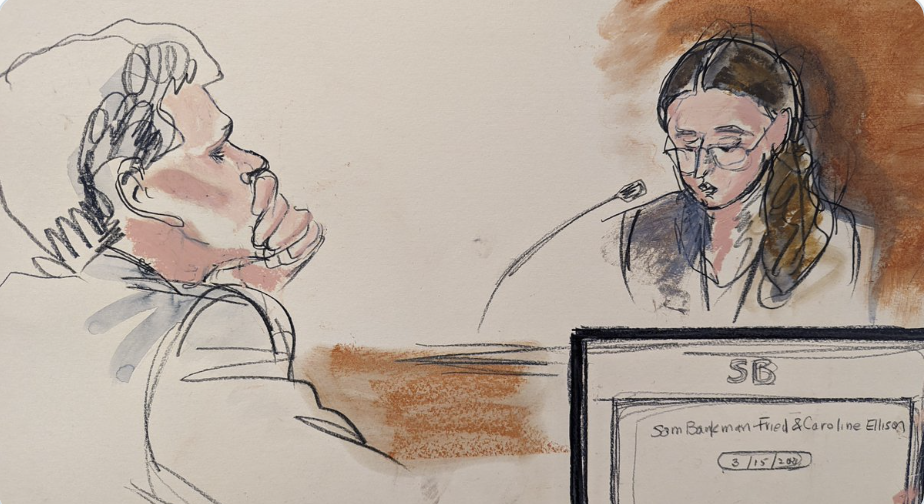

The SEC made the claim in a complaint filed against FTX co-founder Gary Wang and former Alameda Research CEO Caroline Ellison.

In the complaint, it highlighted that FTX would use proceeds from the token sale to fund the development, marketing, business operations and growth of FTX while using language to emphasize that FTT is an “investment” with profit potential.

“The FTT materials made clear that FTX’s core management team’s efforts would drive the growth and ultimate success of FTX,” the complaint read.

FTT’s “buy-and-burn” program was also mentioned. This initiative, used by many other exchange tokens, is akin to a stock buyback where revenue from FTX would repurchase and burn FTT, thus increasing its value.

Ellison and Wang have both pled guilty to the various charges brought before them, and are not contesting the SEC’s allegations, the agency said in a press release.

The two are also facing Justice Department and Commodity Futures Trading Commission (CFTC) charges related to their conduct at FTX and Alameda, respectively. “FTT investors had a reasonable expectation of profiting from FTX’s efforts to deploy investor funds to create a use for FTT and bring demand and value to their common enterprise.” the SEC added.

The price of other exchange tokens don’t appear to be moving on the news. The price of Binance’s BNB token remained stagnant after the news broke, declining 0.17% during the Asia morning to $248, according to CoinDesk data. Huobi’s HT token is down 2% to $5.29, while OKX’s OKB token is up 1.3% to $22.82.

BY: Sam Reynolds

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.