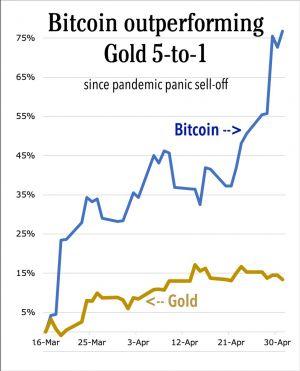

Gold’s Post-Pandemic Upside Is Huge. But it Pales Alongside Bitcoin

As pandemic panic crushes the life out of the global economy, central banks are pouring trillions of dollars into the global money supply.

And America’s Federal Reserve is leading the way.

It’s printing money at such a furious pace, it makes the huge rescue following the failure of Lehman Brothers in 2008 look like pale, stale, ale by comparison.

Naturally, wholesale debasement of fiat currencies worldwide is starting to fuel near-insatiable demand for assets beyond the reach of bureaucrats, politicians and governments to corrupt.

For centuries, gold has been investors’ first choice in this regard. But thanks to the blockchain revolution, we now have Bitcoin (BTC, Tech/Adoption Grade “A”) — which is giving gold a run for its money.

Bitcoin offers as tough a defense as gold against government manipulation and control.

But in other key respects, it has advantages gold cannot possibly match. For example:

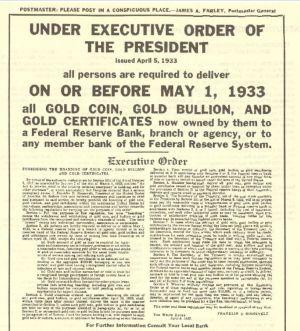

Confiscation Resistant. Government bureaucrats cannot inflate away the purchasing power of your gold like they can with fiat currency. But they can send their storm-troopers stomping in to seize it.

- In 1933, a US President famously confiscated all the gold in America.

- Australia’s 1959 Banking Act empowered the government to force private citizens to turn in their gold for paper currency.

- In 1966, Britain’s Labor government made it illegal for any person to own more than four precious metal coins.

Bankrupt, spendthrift governments — especially when their backs are against the wall — will grab just about any assets they can lay hands on.

Just seven years ago, for example, the government of Cyprus confiscated up to 10% its citizens’ and residents’ bank savings. And now …

As the full extent economic devastation wrought by pandemic lockdowns becomes undeniable … a lot of chickens are going to come home to roost.

Already, Argentina is on the brink of its ninth sovereign default. The ruling mullahs in Teheran are about to knock four zeros off their nearly worthless paper currency (USD 1=42,105 Iranian rials) and re-issue it.

As a result, the possibility your gold may be stolen or confiscated is hardly abating. Quite the opposite. It’s fast approaching the danger zone. But not so with Bitcoin.

The only physical manifestations of your Bitcoin ownership are the character strings that comprise your wallet address and private key.

Never has a financial asset been more easily concealable — and therefore less confiscatable — than this.

Transport. Gold is 70% heavier than lead. Plus, it requires guards with guns to protect it in transit. That costs money.

Also, bank vault services, armed guards, and armored transport services are usually heavily regulated businesses. That means you need at least tacit permission from the government to make any kind of a move.

What if you don’t have special permission from the government?

Just look at what happened to Venezuela when it tried to access [USD] 1.2 billion of its own gold reserves from the Bank of England — where it was supposed to be held in safe custody!

By contrast, Bitcoin is weightless and travels over the Internet without anyone’s permission. And at near zero cost.

Holding Costs. Gold requires a secure location. If you don’t have your own vault, you will have to rent one at a bank or other trusted institution. By contrast, Bitcoin costs nothing to store.

For all these reasons, we think it’s pretty clear …

Bitcoin’s post-pandemic upside is going to be bigger than gold.

Indeed, recent history bears this out. After world central banks went on their money-printing rampage in 2008 …

- Gold shot up roughly 200%, eventually topping out near [USD] 1,900 — which ain’t bad!

- But Bitcoin blasted up about 1,000,000%, topping out near [USD] 20,000.

To be clear, we’re not saying Bitcoin is going to go up another million percent from here (almost USD 10,000 today). But 3- or 4-fold gains are well within the realm of possibility. Already, since the mid-March flash-crash in the investment markets, Bitcoin has been outperforming gold 5-to-1.

Juan Villaverde is an econometrician and mathematician devoted to the analysis of cryptocurrencies since 2012. He leads the Weiss Ratings team of analysts and computer programmers who created Weiss cryptocurrency ratings.

Dr. Bruce Ng is an educator in the field of Distributed Ledger Technology (DLT) and has been a lead crypto-tech analyst for Weiss Cryptocurrency Ratings since shortly after their launch.

Responses