Crypto Funds See Largest Weekly Outflows Since January

Some $134 million flowed out of digital asset funds in the week through April 8 as investors took profits and fled bitcoin-focused funds.

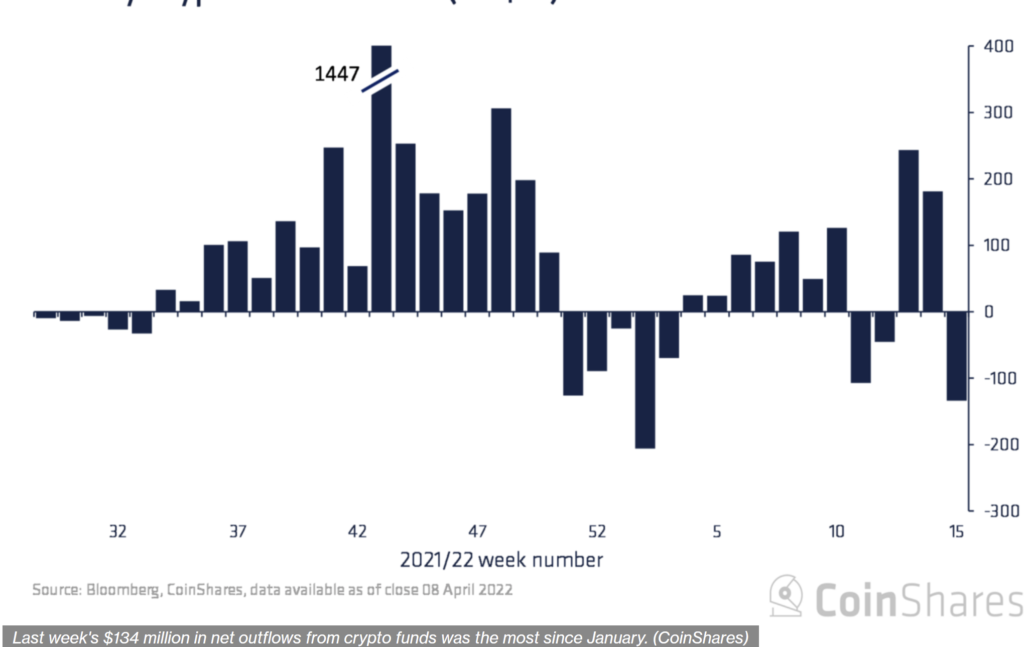

Crypto funds last week suffered their largest outflow since January as investors withdrew money from bitcoin and Ethereum funds, CoinShares reported on Monday.

The funds had $134 million in net outflows, which marked the second worst week in the year for funds that manage digital asset investments and represented a sharp turn after two straight weeks of heavy inflows.

Bitcoin-related products took the lion’s share of the outflows with $131.8 million of redemptions. Short bitcoin investment products, which bet on making profits when bitcoin’s price declines, saw inflows totaling $2 million, their largest inflow on record.

The reversal came after the price of bitcoin (BTC), the largest cryptocurrency by market capitalization, rose to $48,000 from $38,000 in only two weeks by early April.https://imasdk.googleapis.com/js/core/bridge3.509.0_en.html#goog_19566469782

“We believe price appreciation the previous week may have prompted investors to take profits,” the report said. Lower daily trading volumes ($2.3 billion) than the average also suggest that there isn’t significant stress among investors.

Funds focused on Ethereum (ETH) saw $15.3 million in outflows, which brought year-to-date total outflows to $126 million.

Meanwhile, altcoins (excluding Ethereum) and multiple-asset funds stayed resilient and recorded inflows of $6 million and $5 million, respectively.

Breaking down the funds by assets, solana (SOL) led the way with $3.7 million in inflows, down from $8.2 million the week before, bringing its year-to-date inflows to $107 million.

Funds focused on cardano (ADA) saw $1 million in inflows, while $600,000 flowed into litecoin (LTC) funds.

Outflows were broad among providers as both European and America-based funds booked outflows, with American providers representing 61% of the outflows.

Funds managed by ProShares and ETC Group took the biggest hit with outflows of $64.5 million and $45.8 million, respectively.

BY: Krisztian Sandor

DISCLOSURE

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.