Bitcoin Still (BTC) Likely To Rally Towards $5,800 By End Of The Month

Bitcoin (BTC) is still very likely to rally towards the resistance zone at $5,800-$6,000 despite the recent retracement. The price rallied too high too soon and this pullback was expected. The price seems to have reverted to mean within the ascending channel it is trading in. Now we can expect it to consolidate for a whole before rallying towards $5,800. We have long been expecting this retest as discussed in my previous analyses. If the price is to go down towards $1,800 it has to face a strong rejection at the previous market structure which is also the resistance zone of $5,800-$6,000. The 4H chart for BTC/USD shows that the price has found support at the 21 EMA for now. It is likely to continue to consolidate above this level before the next run up.

RSI has retraced significantly on the 4H chart following the recent pullback. This has created ample room for a rally towards the resistance zone at $5,800-$6,000. However, the price continues to remain heavily overbought on the weekly time frame which is why a sharp move to the downside is expected sooner or later. The price still has plenty of room on shorter time frames to rally towards $5,800. The bullish excitement has not died down after the recent pullback. Most retail bulls still expect the price to pierce straight through the strong resistance zone of $5,800-$6,000 and rally towards $8,000 or higher levels in the weeks ahead. There are also a lot of people that think the price could not possibly fall towards $3,000 without there being a lot of people trying to buy it up. This is exactly what people thought when the price was at risk of falling below $5,800 and we know how that turned out.

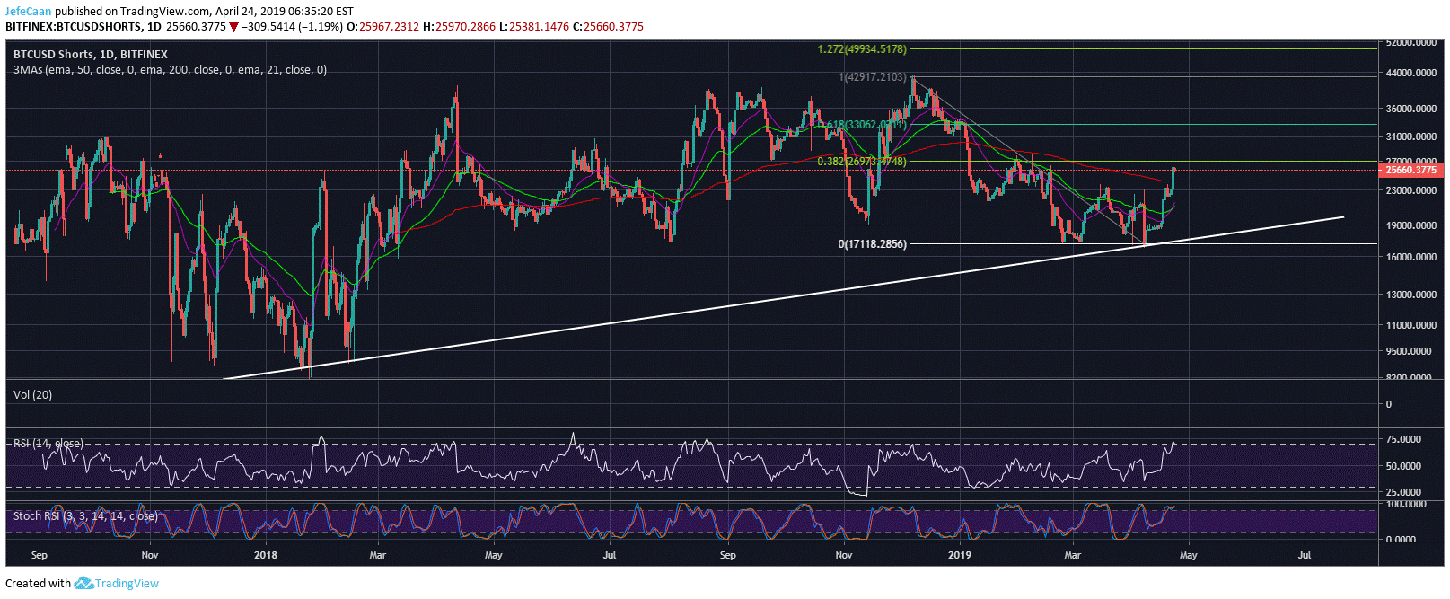

The daily chart for BTCUSDShorts shows that the number of margined shorts is expected to see a sharp decline in the days ahead. BTCUSDShorts is about to run into a 38.2% Fib retracement level and it is very likely to be rejected there. RSI on the daily time frame is near overbought territory and a pullback is likely sooner or later. The recent rallies got the bears very excited and most of them have been piling up on new short positions only to see the price going higher and higher. We expect the price to continue to surge higher in the days ahead with most bears rushing to close their margined shorts as they see the price keep on rallying.

There is no denying that the price is going to decline sharply in the weeks ahead. Even those that think the price has bottomed realize that a pullback is inevitable if the price is going to continue this rally to the upside. Realizing this, a lot of traders have been very comfortable with opening margined shorts which is why the number of shorts shot up since the beginning of the month. BTCUSDShorts is now trading above the 200 day EMA which is a strong indicator that the bears are now close to assuming control. Even if we see a sharp decline in the number of margined shorts in the days ahead, the bulls still need to be very cautious as this is the time to be selling, not buying.

Responses