Cryptocurrencies Affirm to Debut Crypto, Debit Products in Push Toward Super App

Affirm Holdings Inc. is planning to debut a debit card and allow customers to buy and sell crypto directly from savings accounts they have with the company as part of a broader push to become a one-stop shop for consumers’ financial needs.

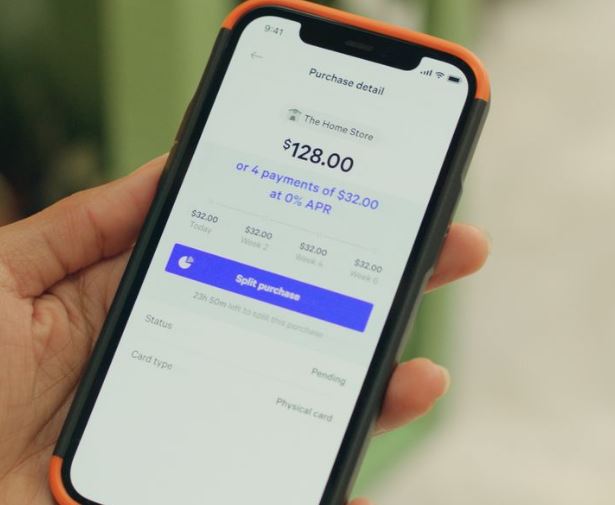

Affirm — known for letting customers split up purchases and pay them off over time — is also weighing expanding internationally, the San Francisco-based company said Tuesday at an investor presentation.

“Our superpowers are in developing sophisticated, scalable technology, risk management and highly efficient access to capital,” Chief Executive Officer Max Levchin said during the presentation. “Expect us to look for more opportunities to buy and build, as we look to leverage our core strengths.”

With its latest ambitions, Affirm is joining a bevy of banks and technology giants hoping to become the world’s next “super app,” akin to China’s Alipay or WeChat, India’s Paytm or Singapore’s Grab. Those companies combine everything from financial services and payments to food delivery and shopping in one place.

Affirm’s customers are already starting to turn to the company in this way. Roughly a third of its transactions originate from Affirm’s website and app rather than a merchant partner’s website.

With the new crypto offering, customers will be able to buy and sell digital currencies including Bitcoin directly from the Affirm app. The company is working with New York Digital Investment Group LLC on the offering, according to a presentation on its website.

“We are doing it in a way that feels natural to us,” Levchin said in an interview. “We will make it really simple, it’s safe, we won’t let you do crazy things.”

Customers will be able to use the debit card to pay online or in stores, and Affirm will later notify customers if a purchase is eligible to be split up and paid off over time. The company’s merchant partners will be able to market specific offers and discounts to consumers based on data the company has on specific items they buy, Levchin said.

“Unlike Visa and Mastercard and the traditional payment networks, we know what is being transacted — we know what items they’re buying,” Levchin said. “It allows us to say, ‘This merchant wants you to buy this thing and the maker of this thing wants you to pay no interest at all — they’ll give you a discount.’”

Affirm went public in January, and its stock has since soared 142%, giving it a market value of more than $32 billion, as consumers flock to buy-now, pay-later services that allow them to pay off purchases over time, often at no interest. Financial-technology companies focused on the space have already diverted as much as $10 billion in annual revenue from banks, according to McKinsey & Co.

Young people “were no longer willing to tolerate getting into permanent debt by ‘putting it all on the card,’” Levchin said during the presentation. “Of course, as millennials, and Gen Z after them, came of age, they too faced the need to purchase things that did not comfortably fit into their regular cash flow — the need to pay for things over time. This need is what gave rise to the entire BNPL industry.”

Responses