Market Wrap Year-End Review: Altcoins, NFTs Filled Void When Bitcoin Got Boring

In mid-2021, crypto traders turned their attention to “Ethereum killers” and ridiculous-seeming NFTs that fetched hundreds of thousands of dollars.

Altcoin season in full effect

Around the start of the year, multiple altcoins began to outperform bitcoin (BTC), reflecting a strong appetite for risk among investors. The payments token XRP rallied nearly eightfold between January and April, and the prices of many decentralized finance (DeFi) tokens such as Aave’s AAVE token and Uniswap’s UNI also soared.

Even during the broad crypto market sell-off, altcoins began to account for a greater share of the total crypto universe – shrinking bitcoin’s “dominance” in the industry jargon. Many “Ethereum killers,” or competitors in the field of smart contracts blockchains, began to grab the attention of traders – such as Solana, with its SOL token. So-called layer 2 tokens such as MATIC from Polygon, which aims to increase the efficiency of transactions on the Ethereum blockchain, rose nearly twofold in July.

The chart below shows bitcoin’s market capitalization relative to the total crypto market capitalization, known as the bitcoin dominance ratio. BTC’s relative market cap loss began to accelerate between March and May before stabilizing at around 40% in the following months.

Bitcoin dominance ratio (CoinDesk, TradingView)

The NFT craze

As bitcoin’s price stabilized at around $30,000 in July and August, some traders became bored, literally.

It had been clear since March just how far this year’s crypto craze extended beyond bitcoin, when a piece of digital artwork sold for $69.3 million at a Christie’s auction by crypto artist Beeple. In the wake of breathless headlines in traditional media outlets like the New York Times, the potential riches from selling non-fungible tokens, or NFTs, attracted scores of artists, celebrities and traders seeking additional investments in the crypto market.

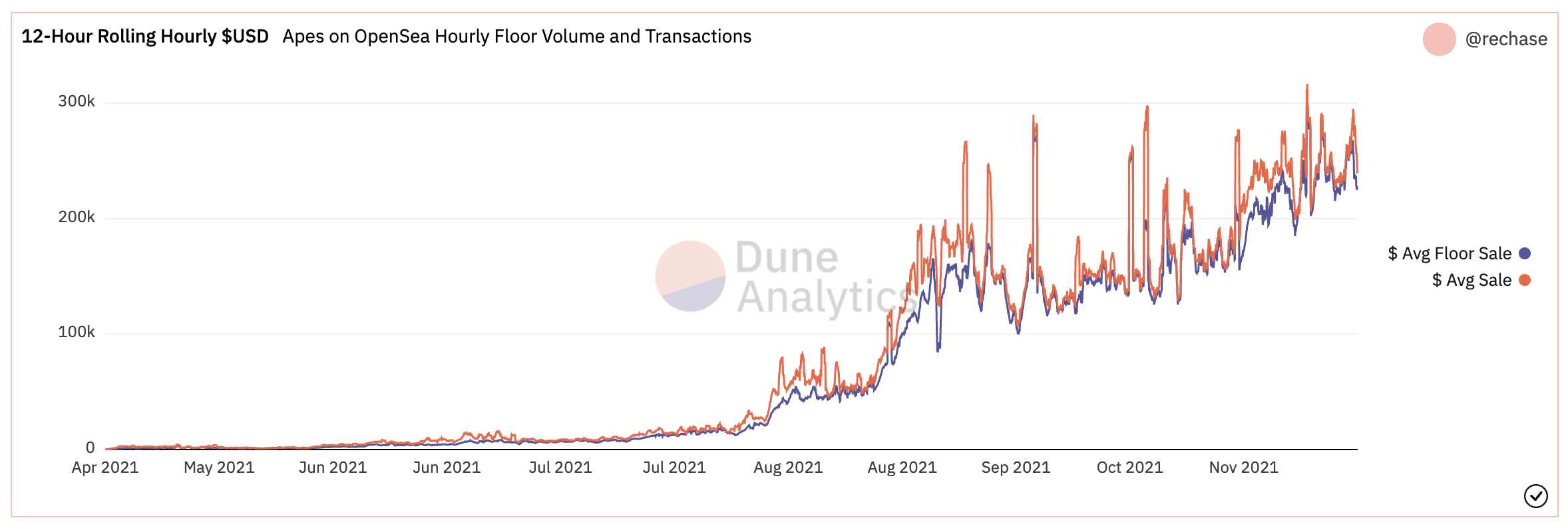

The Bored Apes Yacht Club became the second-most popular NFT collection by total trade volume behind CryptoPunks, CoinDesk’s Eli Tan wrote in August. At that time, the “floor price” for Bored Ape Yacht Club NFTs – the cheapest available on the open market – was 48.8 ETH, or $165,578. (By the end of the year, it would rise even further, to about $240,500.)

Owners of the high-priced NFT collection include National Basketball Association superstar Steph Curry, YouTube creator Logan Paul and musician Jermaine Dupri.

Dune Analytics: Average Bored Ape Sales Price

Speculation moves in cycles. Crypto traders began the year in full buying mode and then price declines encouraged some profit-taking as regulatory risks unfolded. The speculative wave had its ups and downs, but traders were able to find opportunities in the alternative crypto market as bitcoin began to lose its relative dominance.

In the next episode, we’ll show how bitcoin’s price broke out of a two month-long sideways range as El Salvador came to the rescue.

Relevant News

Latest prices

-

Bitcoin (BTC): $47,735, -6.8%

-

Ether (ETH): $3,823, -6.6%

-

S&P 500: -0.1%

-

Gold: $1,807, -0.1%

-

10-year Treasury yield closed at 1.482%, up 0.003 percentage point.

CoinDesk 20

Here are the biggest gainers and losers among the CoinDesk 20 digital assets, over the past 24 hours.

Biggest gainers:

Biggest losers:

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to provide a reliable, comprehensive and standardized classification system for digital assets. The CoinDesk 20 is a ranking of the largest digital assets by volume on trusted exchanges.

BY: Damanick Dantes

DISCLOSURE

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.

Responses