Litecoin Is Undervalued, Onchain Indicator Suggests

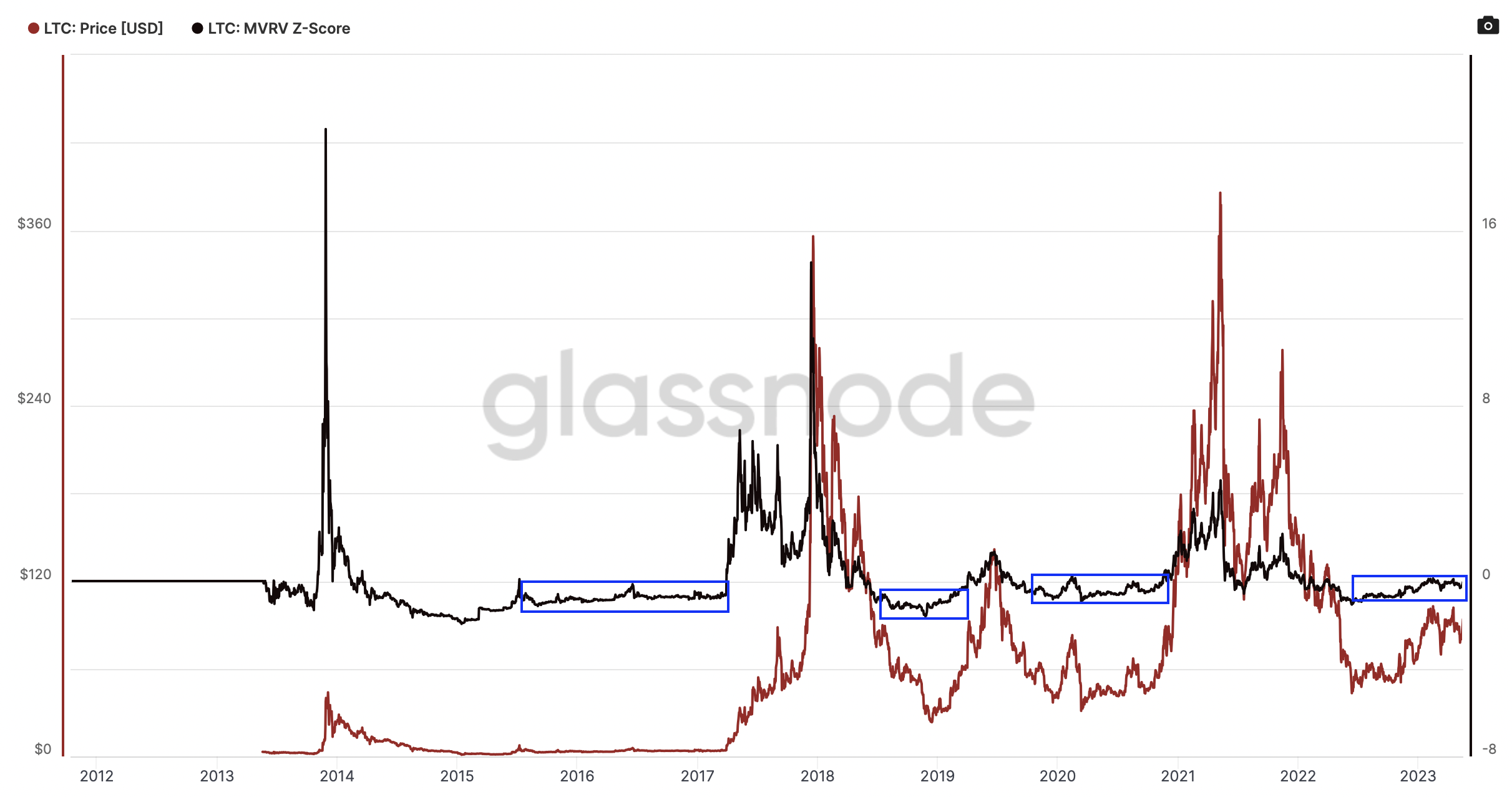

Litecoin has rallied nearly 31% so far this year, but is still trading at discounted prices, according to an onchain metric called the MVRV Z-score.

An onchain metric suggests that litecoin (LTC), the 12th largest cryptocurrency by market value, is trading at discounted prices.

Litecoin’s market value to realized value (MVRV) Z-score was negative at press time. A sub-zero score indicates the cryptocurrency is undervalued relative to its fair value, according to analytics firm Glassnode.

The market capitalization is calculated by multiplying the total number of coins in circulation by litecoin’s going market rate. The realized value is a variation of the market cap that adds the market value of coins when they last moved on the blockchain.It excludes all coins lost from circulation (more than 15%) and is said to reflect the real or fair value of the network.

The Z-score shows by how many standard deviations the market value differs from the realized value.

Historically, Z-scores above eight have signified overvaluation and bull market tops, while negative values have indicated undervaluation and market bottoms.

The chart shows the Z-score has been consistently negative since July last year.

That’s not new. The indicator has consolidated below zero several times in the past, eventually paving the way for meteoric bull runs.

If history is a guide, the path of least resistance appears to be on the higher side. That said, litecoin and the broader crypto market remain vulnerable to adverse macroeconomic developments like liquidity tightening and the state of the global economy.

At press time, LTC changed hands at $92, representing a nearly 31% gain for the year. Prices clocked a one-month high of $95 early this week, per CoinDesk data.

Litecoin is set to undergo its third mining reward halving in early August, following which the per-block reward paid to miners will reduce by 50% to 6.25 coins from 12.5 coins.

BY: Omkar Godbole

Edited by Parikshit Mishra.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.