First Mover Americas: Bitcoin Shaky as Traders Bank Profits

The latest price moves in crypto markets in context for Nov. 15, 2024.

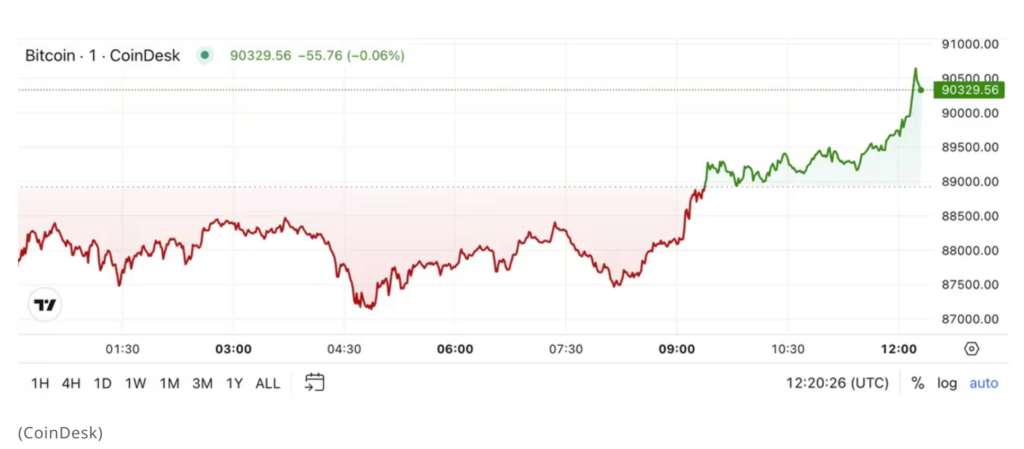

Bitcoin pared some of Thursday’s losses during the European morning to trade above $90,000. BTC remains over 1% lower in the last 24 hours, a possible sign of profit-taking following its surge above $93,000 earlier in the week. The drop was catalyzed by Fed Chair Jerome Powell’s hawkish comments that damped hopes of swifter interest-rate cuts. “The economy is not sending any signals that we need to be in a hurry to lower rates,” Powell said in prepared remarks at a Dallas conference. As of Friday, the market is pricing in a 66% chance of a 25 basis-point cut at the December FOMC meeting, down from Thursday’s 83%. The CoinDesk 20 Index (CD20), a measure of the broader crypto market, is 0.66% higher.

Bitcoin ETFs saw $400 million of net outflows on Thursday, their third-highest loss since they listed in January. Fidelity’s FBTC saw outflows of $179.2 million, Bitwise BITB saw $113.9 million being drained, Ark’s ARKB bled $161. 7 million, while Grayscale’s two products notched combined outflows of $74.9 million. Similar to the dip in the underlying asset, ETF outflows may be a sign of investors taking profits. BlackRock’s IBIT saw inflows, gaining $126.5 million, continuing the trend of strong interest since Nov. 7. The only days to have seen larger bitcoin ETF outflows — May 1 and Nov. 4 — both signaled local bottoms before BTC returned to an upward trend.

XRP zoomed 17% in 24 hours to outperform bitcoin and other majors as the shifting U.S. regulatory climate supported growth in tokens previously hampered by the SEC’s actions. XRP traded above 82 cents in early Asian trading hours Friday, extending seven-day gains to 50% and reaching levels last seen in June 2023. The jump came as 18 U.S. states filed to sue the SEC and commissioners, including Chairman Gary Gensler, accusing them of unconstitutional overreach of the crypto industry. The speculative optimism among traders is that a crypto-friendly Trump administration could benefit tokens linked to U.S.-based companies, such as Ripple Labs and Uniswap, as the firms are more involved in boosting value for token holders.

Chart of the Day

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/X5UISIISOZDN3DY26N3UIXIHUA.png)

- BTC has recently bounced off the ascending 100-hour SMA accompanied by a renewed positive crossover on the hourly MACD histogram.

- This arrangement suggests prices might soon challenge the overhead trendline resistance.

- If BTC manages a breakout, we could see new records above $94,000.

- On the other hand, if the price dips below the 100-hour SMA support, it might favor a deeper slide toward the 200-hour SMA at $82,600.

- Source: TradingView

BY: Jamie Crawley and Omkar Godbole

Disclosure

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information have been updated.

CoinDesk is an award-winning media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of editorial policies. CoinDesk has adopted a set of principles aimed at ensuring the integrity, editorial independence and freedom from bias of its publications. CoinDesk is part of the Bullish group, which owns and invests in digital asset businesses and digital assets. CoinDesk employees, including journalists, may receive Bullish group equity-based compensation. Bullish was incubated by technology investor Block.one.