First Mover Americas: A Bleak Month for Crypto as Bitcoin Slides, Ether Stalls and Solana Tanks

Price point

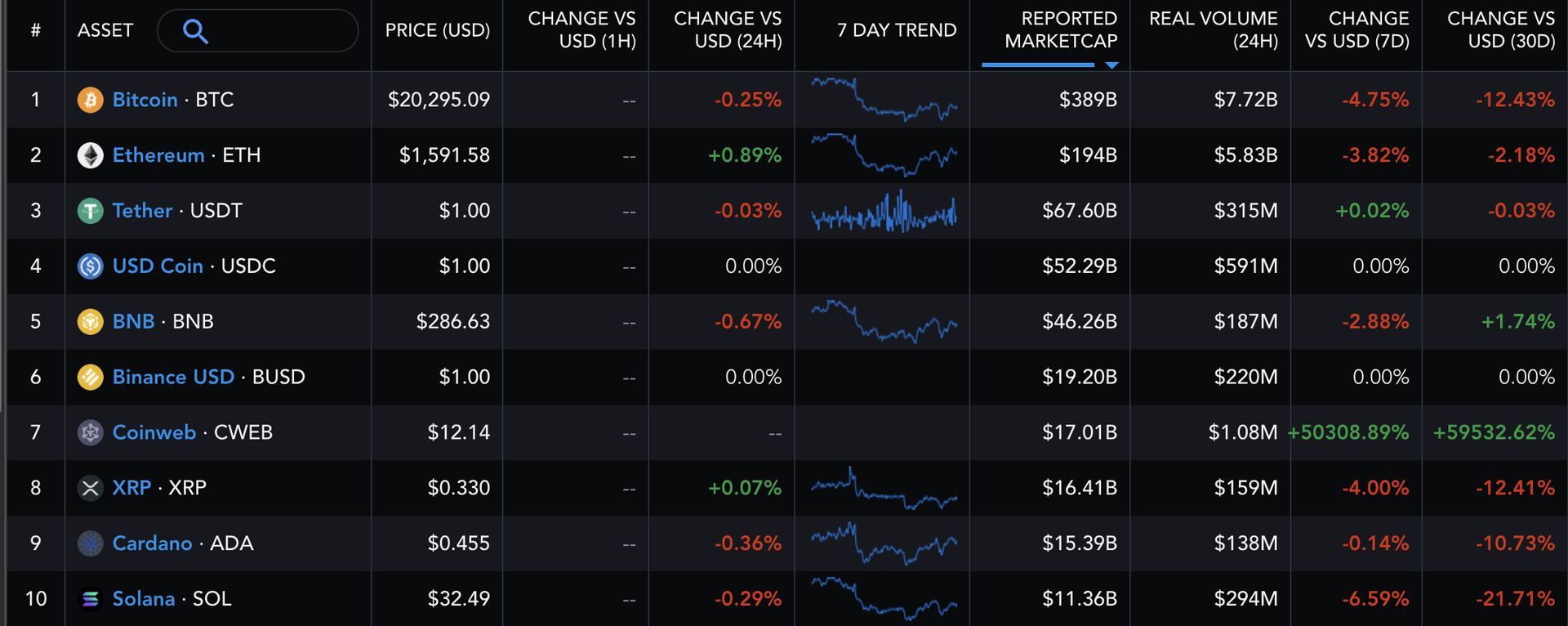

Market conditions remained choppy on Wednesday with bitcoin (BTC) hovering around the $20,300 mark, down slightly on the day. Stocks were mixed and futures tied to the Dow Jones Industrial Average and S&P 500 wavered.

“There’s clearly a lack of conviction in the markets following a lot of hawkish central bank commentary in recent days,” wrote Craig Erlam, OANDA analyst in a morning note.

“The narrative that investors want to believe is that inflation has peaked and is falling in the U.S. and that a soft landing is plausible. That doesn’t necessarily align with what we’re hearing,” said Erlam.

The UK, U.S. and EU are all on track for 75 basis point (0.75 percentage point) interest-rate hikes next month, making it unsurprising that investors are taking a more cautious stance, according to Erlam.

In the news, decentralized finance (DeFi) lending protocol Compound (COMP) has suffered a critical failure, effectively halting the trade of Compound Ether (cETH), after a bug was discovered in the code that causes transactions for suppliers and borrowers of ether to revert.

A report from Morgan Stanley said the combined market capitalization of the two largest stablecoins, tether (USDT) and USD Coin (USDC), has begun to fall again, a sign that quantitative tightening in the crypto financial system has resumed.

And finally, Pantera Capital Chief Operating Officer Samir Shah appears to have left the cryptocurrency-focused investment firm after barely two months, according to his LinkedIn profile.

Biggest Gainers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Terra | LUNA | +3.1% | Smart Contract Platform |

| Cosmos | ATOM | +2.7% | Smart Contract Platform |

| Polygon | MATIC | +2.2% | Smart Contract Platform |

Biggest Losers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Loopring | LRC | −1.1% | Smart Contract Platform |

| Gala | GALA | −1.1% | Entertainment |

| Shiba Inu | SHIB | −1.0% | Currency |

Market Moves

August recap

Looking back over the month of August, the top 10 cryptocurrencies by market value were all mostly trading in the red. Solana’s SOL took the largest hit, down 21%. Bitcoin fell 12% over the month and ether lost 2%.

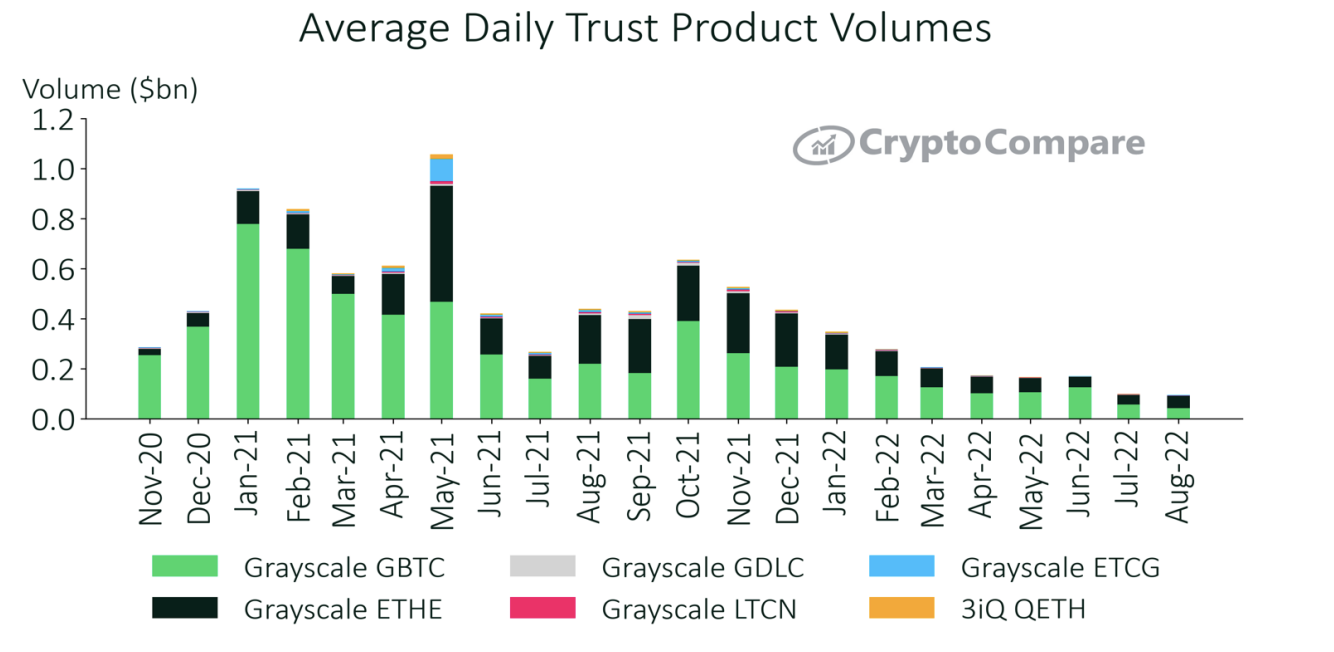

Bitcoin products struggle

In August, bitcoin products struggled, whilst Ethereum-based products saw gains. According to a report from CryptoCompare, bitcoin-based products fell 7.2% to $17.4 billion in August, whilst Ethereum-based products saw gains of 2.36% to $6.81 billion.

“We could be seeing interest move away from bitcoin in the short term, as Ethereum-based products hold the attention with the much-anticipated Merge on the horizon,” said the report.

Ethereum trusts gained volume supremacy

Grayscale’s Bitcoin Trust (GBTC) lost its position as the most traded trust product, according to data from CryptoCompare. (Grayscale is owned by Digital Currency Group, which also owns CoinDesk.)

The average daily volume of the fund totaled $42.3 million (down 24.4%). Grayscale’s Ethereum Trust took the top spot with an average daily volume of $48.7 million (up 23.2%).

Chart of the Day

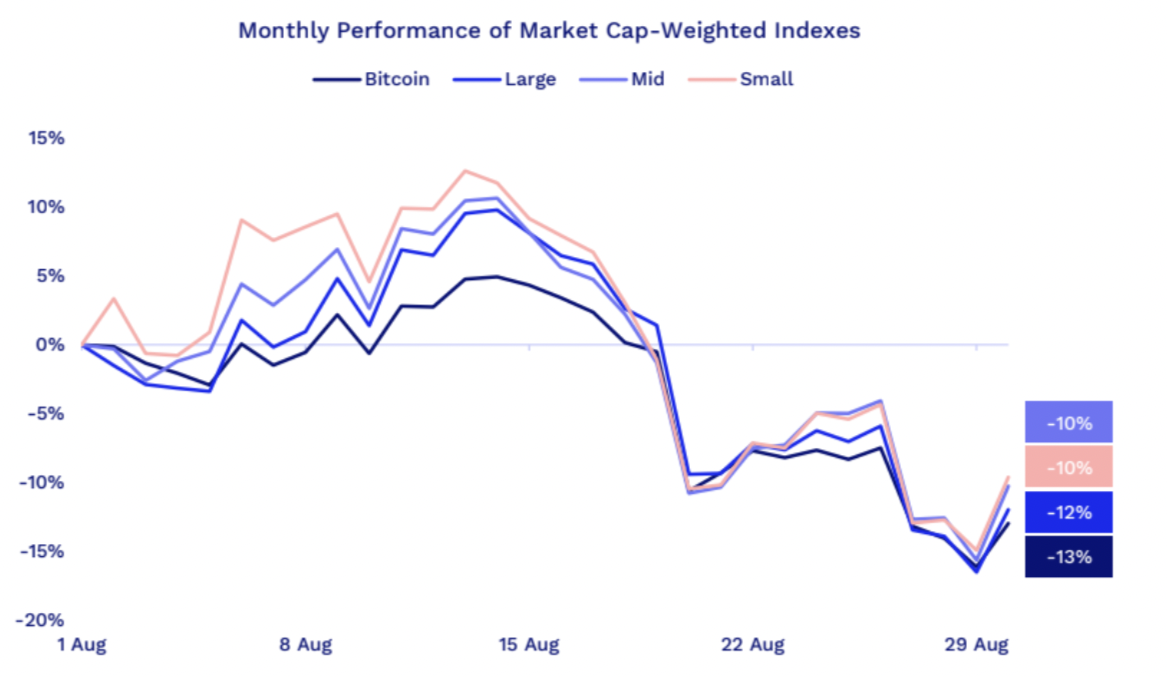

Bitcoin Underperforms The Rest of The Market in August

- Data tracked by Arcane Research shows that bitcoin has underperformed all indexes in August, seeing a monthly loss of 13%.

- All altcoin indexes continue to move in tandem in August, with performance ranging from -12% to -10%, as we wrap up another red month in crypto.

BY: Lyllah Ledesma

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.